Slack Investor is a great believer in writing about experience and a few (fortunately) minor health matters has had him recently exploring Australia’s health system. In Australia, the General Practitioner (GP) is usually the first port of call if you have a health problem and of Medicare will fund a portion of your costs for a consultation. Your relationship with your GP is an important one and it is vital that you feel comfortable with your GP’s manner, knowledge and skills. There are two tiers of GP pricing in Australia.

- Bulk Billed – where there is no extra consumer payment required if you have a valid Medicare card.

- Mixed Billing – where patients will pay a a bit extra in addition to the Medicare allowance

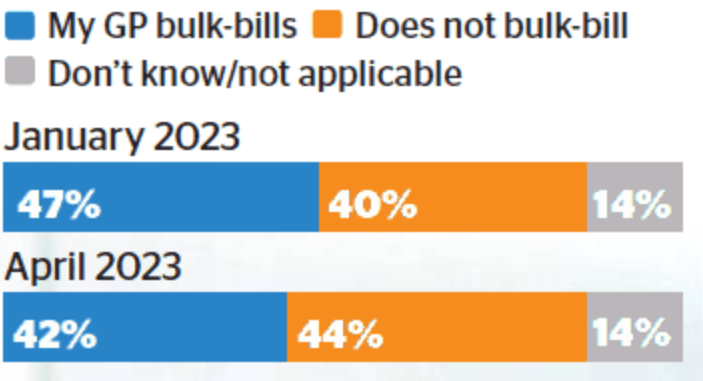

Bulk billing doctors are becoming harder to find as the rate of bulk billing has fallen to its lowest level in 13 years . According to government figures, it was 80.5% in the 2022 December quarter. Though this figures is likely to be “grossly inflated” as many practices have charged a separate eftpos transaction at the desk and this does not appear in Medicare figures.

What should happen is that either the patient is bulk-billed and pays no money – or they are charged a private fee, a portion of which is rebated by Medicare directly into the patient’s bank account.

Dr Margaret Faux, Health Insurance Law Academic

Levels of bulk-billing are probably closer to 40% as shown in the recent survey by The Age. In answer to the question “Does your GP Bulk-bill or charge you a gap fee?”

This Age poll is in line with results by an excellent organisation called Cleanbill that are driven by a mantra that Slack Investor wholly agrees with …

” … healthcare is at its most accessible when you can see all of your options and their costs before you’ve made a booking.”

The mission statement for Cleanbill

The Cleanbill site is easy to use for locating GP’s in your area and transparently gives their total fees for a standard, or a long consultation. Once you have narrowed your search, you can usually make a booking straight from the site.

Only 42.7% of GP clinics serving nearly 18 million Australians

bulk bill (charge no out-of-pocket fee to) all patients.Australia-wide survey by Cleanbill – January 2023

At the 57.3% of GP clinics that charge an out-of-pocket fee the average extra cost for a standard, 15-minute consultation is $40.25 (out of a total cost of $80).

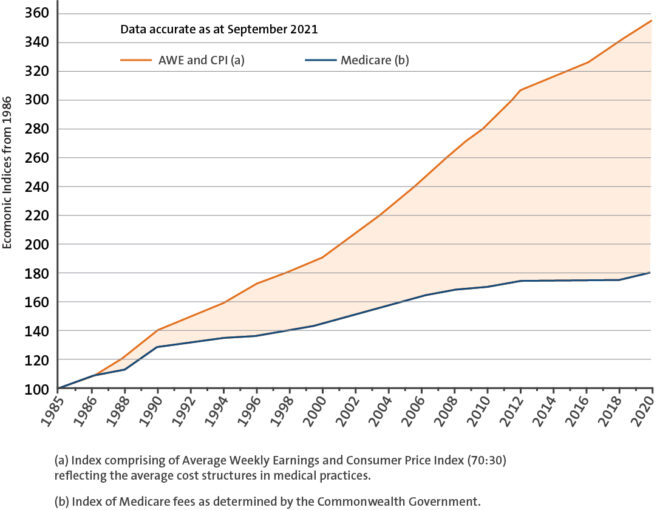

The decline in bulk billing is not the GP’s fault as practice costs have continued to rise and the Medicare rebate has not kept pace with the rise in these costs. In 2013, the rebate was frozen for 6 years – and, even last year, though inflation was 6.1%, the Medicare rebate was only increased by 1.6%. The chart below shows how the rebate has failed to keep pace with inflation (CPI) and average weekly earnings (AWE).

… more than half of GP practices (55%) plan to reduce bulk-billing and increase gap fees this year

2023 GP Insights Report

Are we heading down the track to a US – style system?

Slack Investor has lived in the US – and hopes not! … and, is pleased that the new Australian government is putting a bit of thought and money into this problem with an announced $2.2b injection of funds into Medicare – no detail yet.

Now Slack Investor does not want a completely “free ride” as he realises that healthcare must be paid for. Even in the much admired Scandinavian health systems there is usually a co-payment associated with a visit to a doctor of $20-25 AUD.

In Australia, many patients pay hundreds of dollars for non-GP specialist consultations, and $40–$50 out of pocket for GPs.

Dr Jillian Farmer – Insight Plus

So perhaps it is just a matter of nudging the co-payment down a bit by increasing the Medicare rebate, and some other reforms – all will be revealed on the Australian government budget night – 9 May 2023.

Slack Investor is hoping for some progress as the Australian Healthcare system is generally good … but could be better. In the meantime, if you are looking for a GP, use Cleanbill to help you find one.

April 2023 – End of Month Update

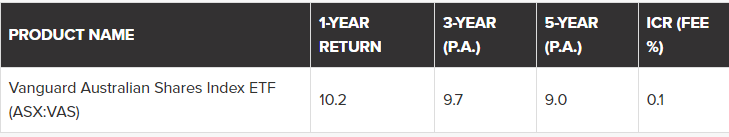

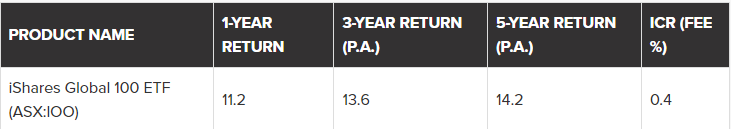

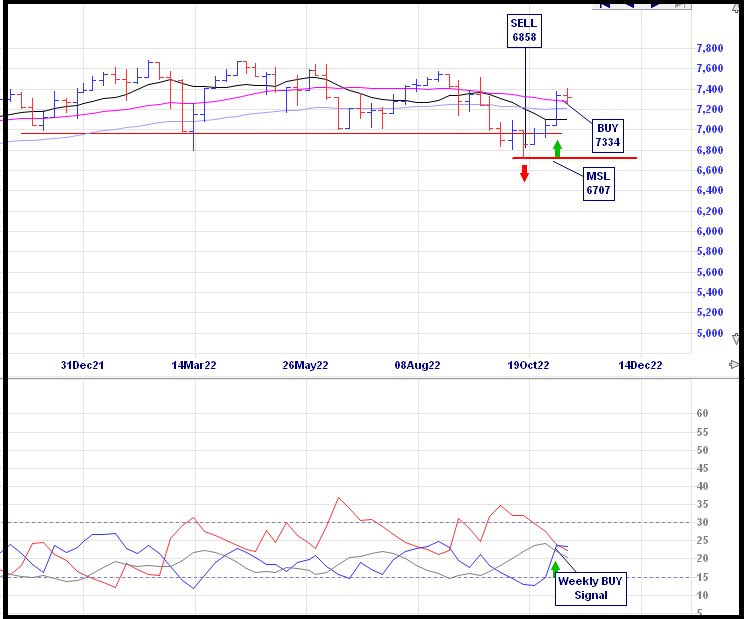

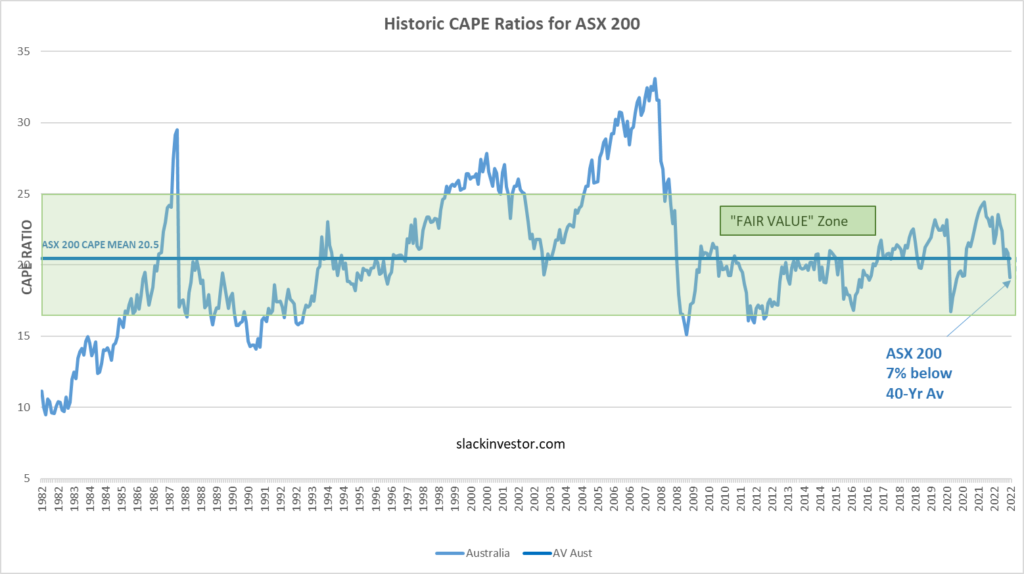

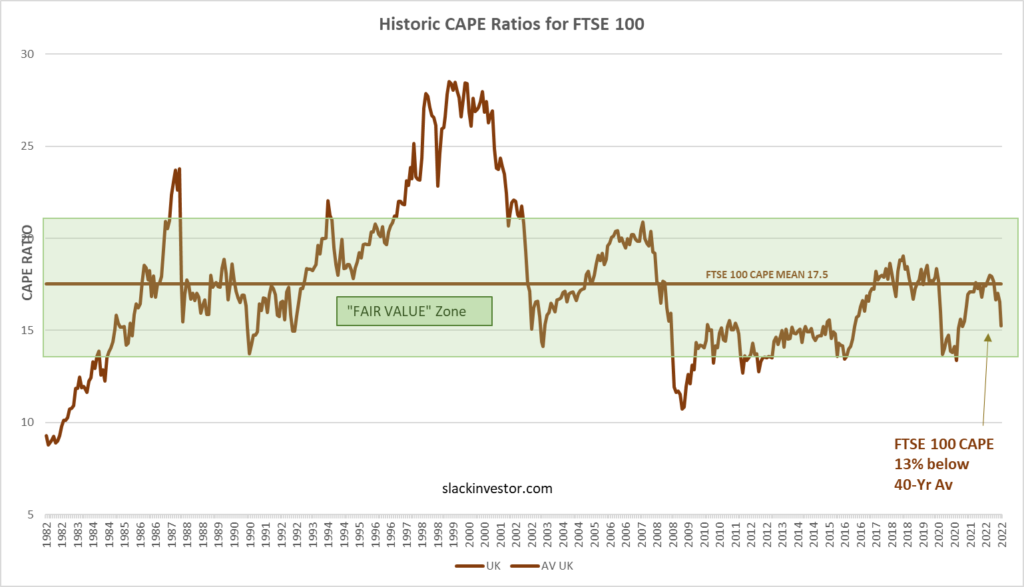

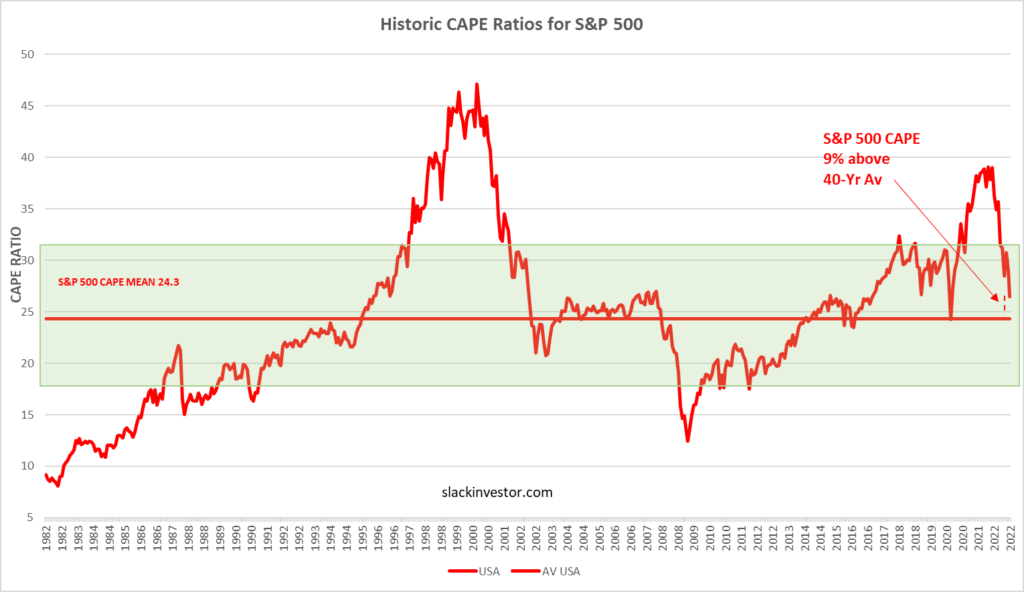

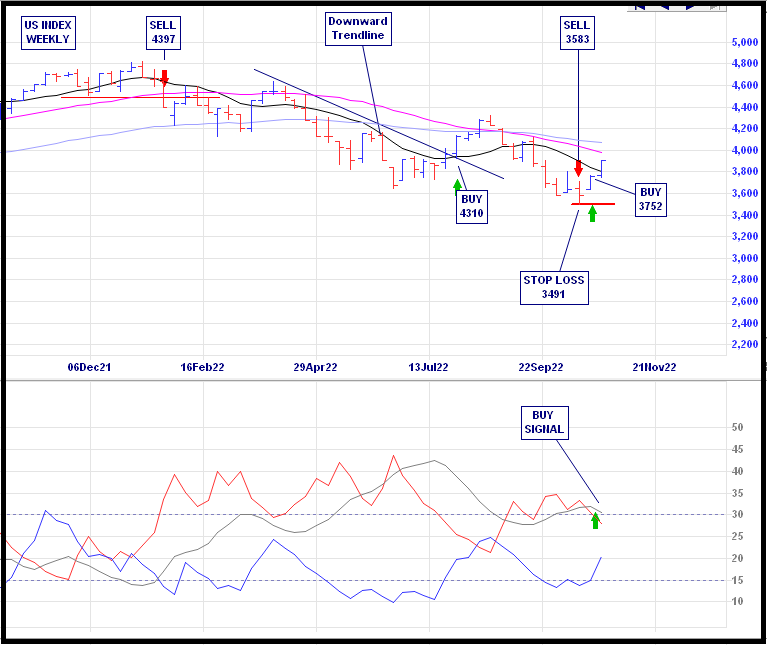

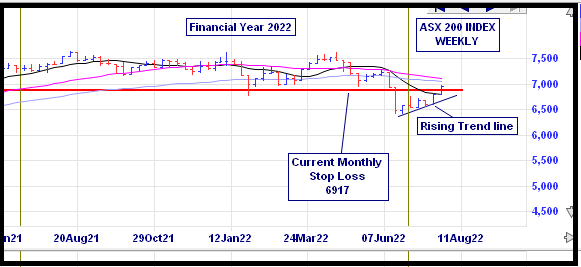

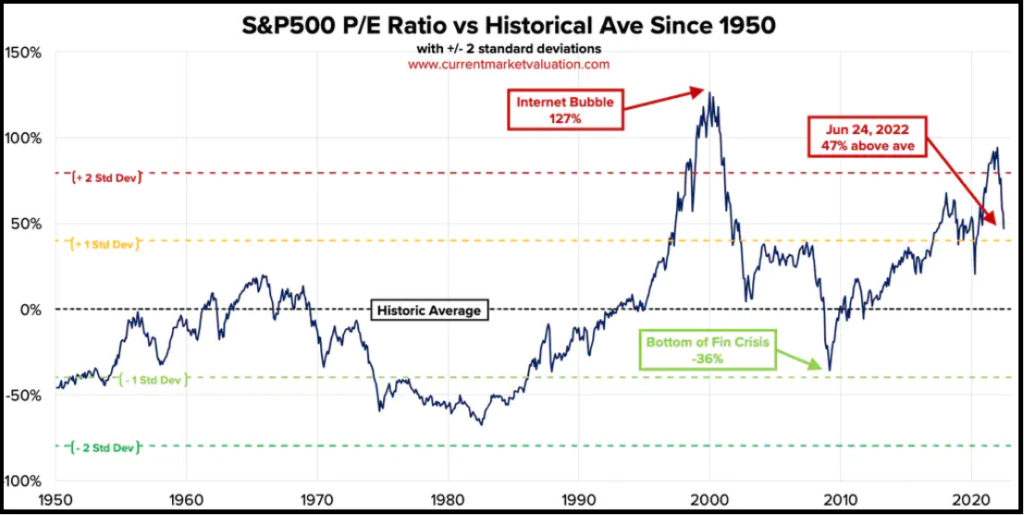

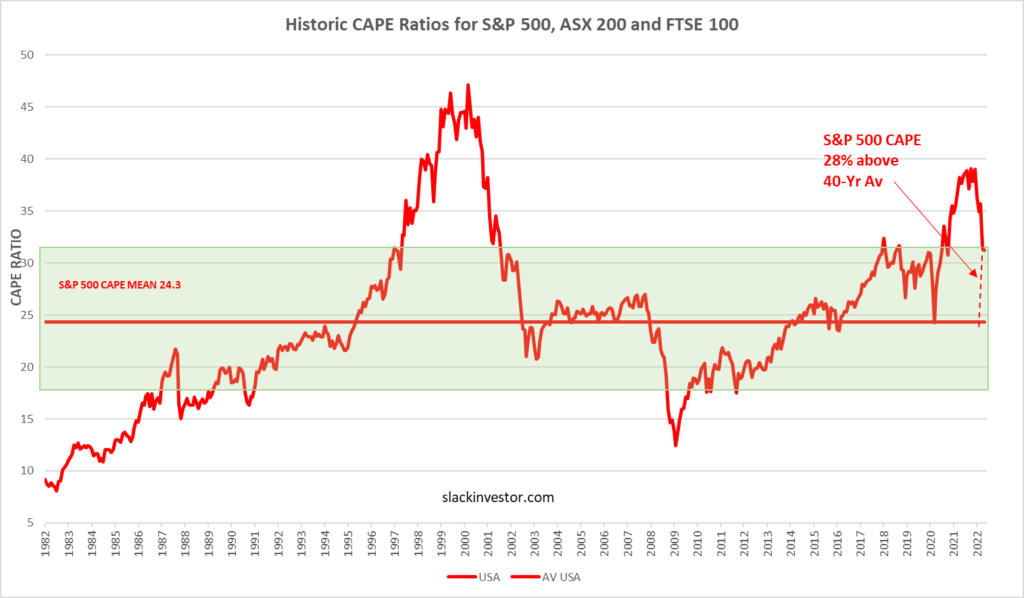

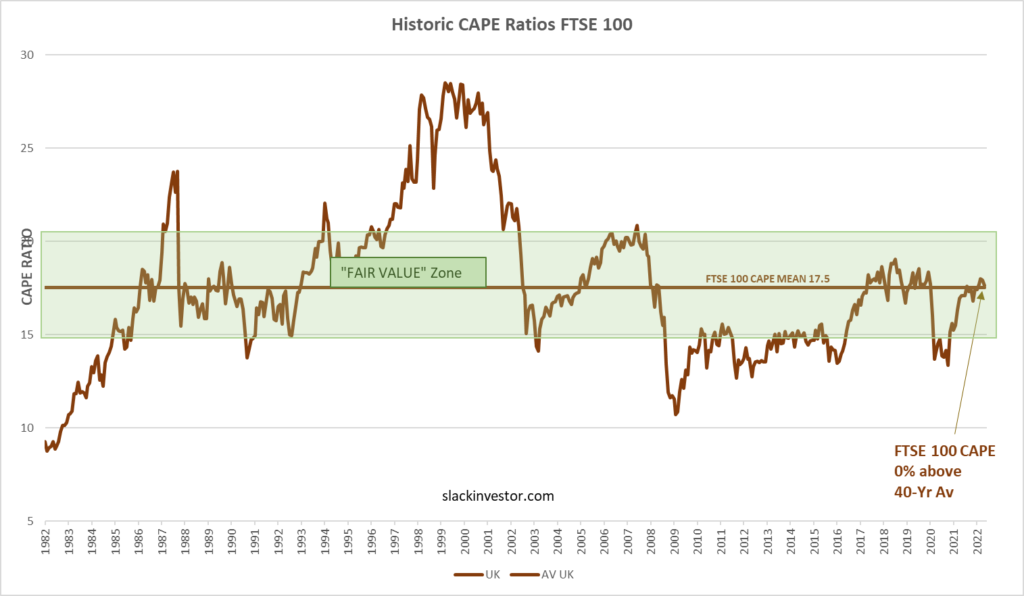

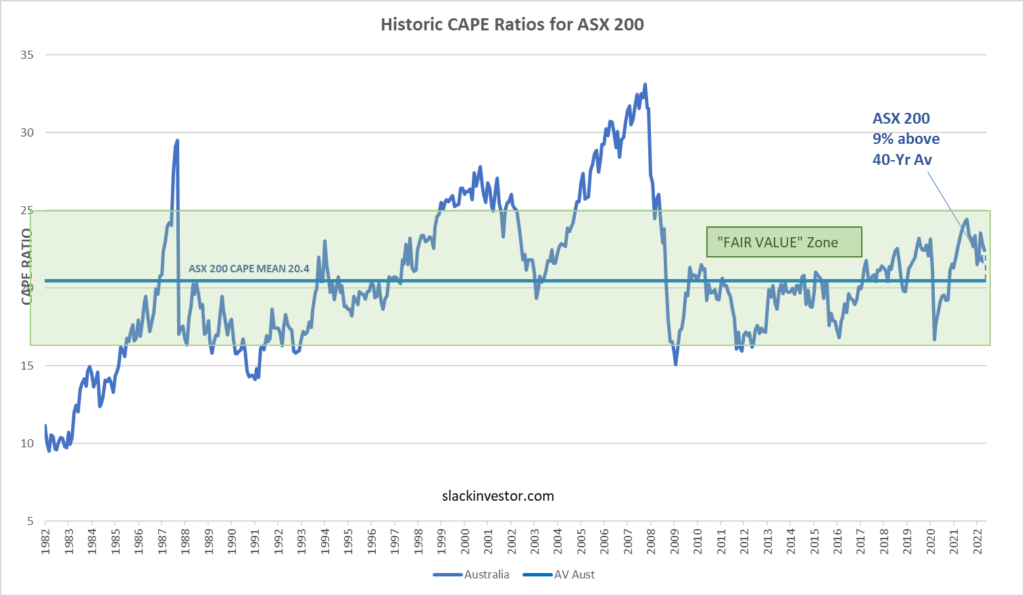

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. It was a positive month for the Slack Investor followed markets. The ASX 200 up 1.8%, the S&P 500 up 1.5%, and the FTSE 100 powering on, and up 3.1% for the month.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).