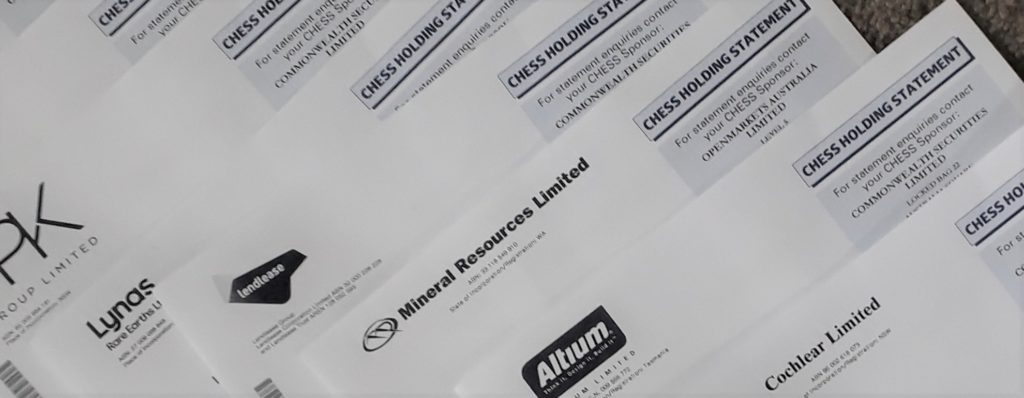

Slack Investor is drowning in paper. Owning shares is a lot of fun but the unnecessary postage and paper is a waste and a frustration. In particular, the posted CHESS Holding Statements from the Australian Securities Exchange (ASX) and useless bits of paper from the share registries are annoying.

(The) ASX sent out 19.2 million paper statements over the year to June (2020), a rise of 34 per cent, as trading surged during COVID-19. The statements used 103 tonnes of paper in the past year.

James Eyers – Australian Financial Review

Australian Investors will be familiar with CHESS, the computerised Clearing House Electronic Sub-register System of the ASX. It was introduced in 1994 and has been around for most of my investing life. All my share holdings are settled through CHESS, through a Holders Identification Number (HIN) and managed by a broker.

There is no doubt that the introduction of this system 27 years ago was a bit of a revolution as it simplified share trading from the cumbersome system of share ownership certificates. It was a world leading technology at the time. However, things have moved on and Slack Investor issues a plea to the ASX, enough is enough with the useless paperwork.

ASX charges companies $1.25 for every “CHESS holding statement” sent out to investors, who receive them even if they quickly sell shares bought. Many investors put them straight in the bin.

James Eyers – Australian Financial Review

I am by no means a frequent trader … but the constant statements that I get mailed to me for every small change in my share balances are a continuing source of frustration.

Although these are mailed out to me at the end of every month – I have never used these statements. The definitive holding record of what shares I own at any given time is held by my CHESS sponsor, my broker (Commsec or SelfWealth).

In the same way I trust my superannuation fund or Bank (i.e not much!), I trust my broker with the record of share ownership – and, I also trust them to work out any dispute if I disagree with their tally. If there ever was a dispute … I would go back to the PDF contract notes and certainly not the paper CHESS Holding Statements to try to resolve it.

How to cope with share record keeping now

At the moment the only way that you can get your Chess Holding Statement is through the post. For 27 years, I have dutifully filed these statements but now, like many of my fellow traders, I have decided to shred them and put them straight in the recycling bin. Shredding is important as these notices contain your name, address and personal HIN.

However, there ARE other very important bits of record keeping that you should try to handle in digital form.

Share Registry Stuff

Share Registries are another intriguing layer in the ownership of shares – and another source of paper and postage. When a company lists on ASX, most companies appoint a share registry to manage the book of shareholders. For we share buyers, the registries manage our share holdings, dividend payments, and the voting at the annual general meeting.

Confusingly, there are three main share registry companies in Australia, Computershare, BoardRoom and Link Market Services and, it is a bit of a raffle which registry manages each company. On purchase, I always label each share with its associated registry. You can look them up at ASX Share Info. For instance CSL is always CSL (C) in my records (Computershare) and Macquarie Group is signified as MQG (L) as it uses the Link registry. I find this cross-linking very handy when chasing down any company payments (dividends) or tax statements and I can’t remember which registry manages the company shareholders.

Whenever you make a share purchase in a new company, through your broker, even though it is using your personal identifier (HIN), at the moment it is necessary to contact the registry and do three things. You will probably be prompted by a paper mail delivery asking you to contact the registry.

- Register your bank account details for dividend payments with each company (even though they may already have them)

- Register your Tax File or ABN number (even though they may already have them).

- Tell the registry how you want to handle all communications – (electronically/email) suits Slack Investor

Every registry change that you make usually generates a letter in the post. They charge the company (we shareholders) for this, though some registries seem to be letting me know by email if they already have my communication preferences.

Keeping track of your finances

These days most share transaction and income finance details are now pre-filled on your tax return. However, it is your responsibility to check on these things and, at a bare minimum, you should download a summary report from your share broker at the end of the tax year. This report contains your buys, sells and income and is usually sufficient evidence for your annual tax return.

A more complete share portfolio solution is using third party financial software such as Sharesight. This is amazing software and is free to use if you have 10 holdings or less. They supply end of tax year reports that even include a capital gains analysis.

Slack Investor is a bit “old school” here and uses the free Microsoft Money Sunset International Edition for portfolio management- But this is dated software now and not recommended for new users.

Because I like to keep track of everything without paper – Slack Investor also sets up folders on his computer for each tax year. There are subfolders for 1. Dividends and Distributions and Tax Statements (From the registries) 2. Broker Transactions.

Dividends and Distributions and Tax Statements: There is no excitement like dividend season as the dividends and distributions roll in via each company registry. I download PDF copies of all payments. I file them on my computer in the format: Tax Year_Investor_Company_Type_Date e.g., 2021_SMSF_CSL_DIV_2021-04-01. Or 2021_SMSF_RBTZ_TaxStatement_20210630.

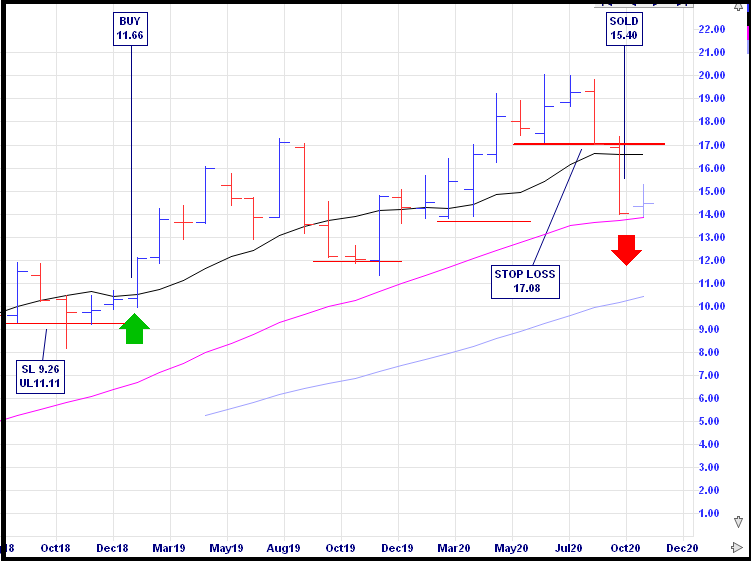

Broker Transactions/ Contract notes: When you buy or sell a share through a broker, a contract note is issued. These should be emailed to you and your broker will keep a copy of them. I also download each contract note for a buy or sell from my broker in the format: Tax Year_Investor_Company_Type_Date e.g., 2022_SMSF_COL_BUY_20210809

Capital Gains: When you sell shares for a profit or loss , you need to declare it on your tax return. Capital gains calculations can sometimes be tricky. A simple example is described in this ABC Overview here and Slack Investor will plan a later article on how to handle more complex cases.

Of course some paper documents still sneak through the Slack Investor fortress and I keep them in a tray in my office and bag them in envelopes labelled with the tax year and keep them for five years, as required by the ATO.

The Future

I am hoping that the share registries can ask the ASX for an email only option for share owners. All registries should have an automatic default instruction to use the same Bank account, tax file # and communication preference – whenever a share purchase is made with your Holder Identification Number (HIN). No announcements from the registries yet – I lie on the couch and dream.

In late 2017, the ASX sent a ripple of excitement through the market, announcing that CHESS would be replaced with distributed ledger technology

Nicola Field, Money Magazine

… but not until 2023. In the meantime, if these holding statements are necessary – can we at least have an e-statement option.

The ASX has had many delays to the starting date of this new technology. Distributed Ledger Technology (DLT) is similar to Blockchain. The full difference between Blockchain and DLT made my head hurt … so I hope they know what they are doing.

But, please hurry up with these reforms ASX … after decades of complaints. Streamline the share registry process, ask us for our email details and give us the option for email delivery of statements. In its current form, the CHESS clearing system and paper mail trails just seems a little bit … of another time.