“I believe in evidence. I believe in observation, measurement, and reasoning, confirmed by independent observers. I’ll believe anything, no matter how wild and ridiculous, if there is evidence for it.

Isaac Asimov – US Author and Biochemist

Good fortune has prevailed in FY 2023. After the tough investing year of FY2022, Slack Investor has stuck to his strategy of investing with growing companies that have an established earnings record and forward P/E ratios <50 (Mostly!). As always, there have been a few lapses, but that’s just part of being an investor.

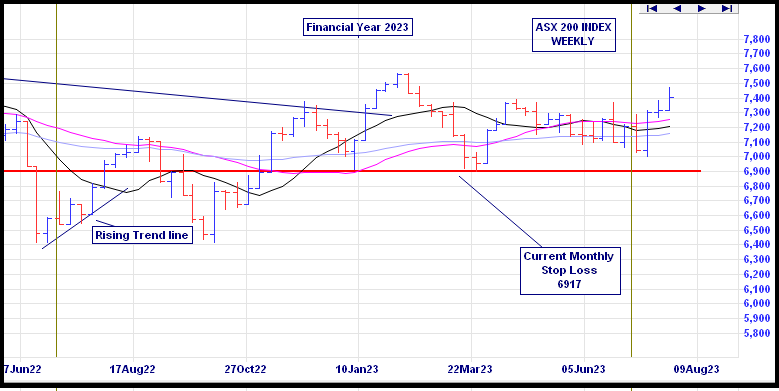

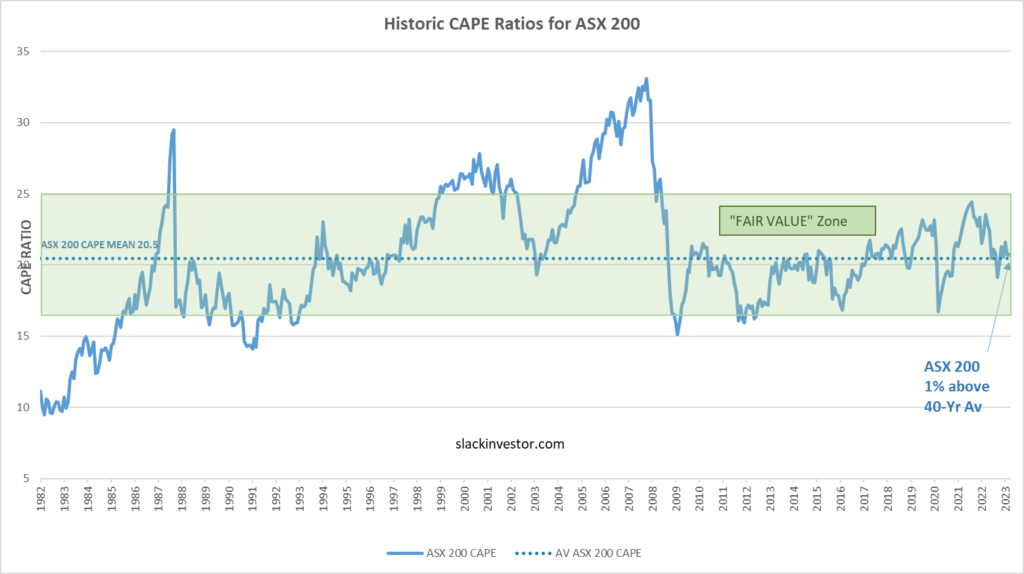

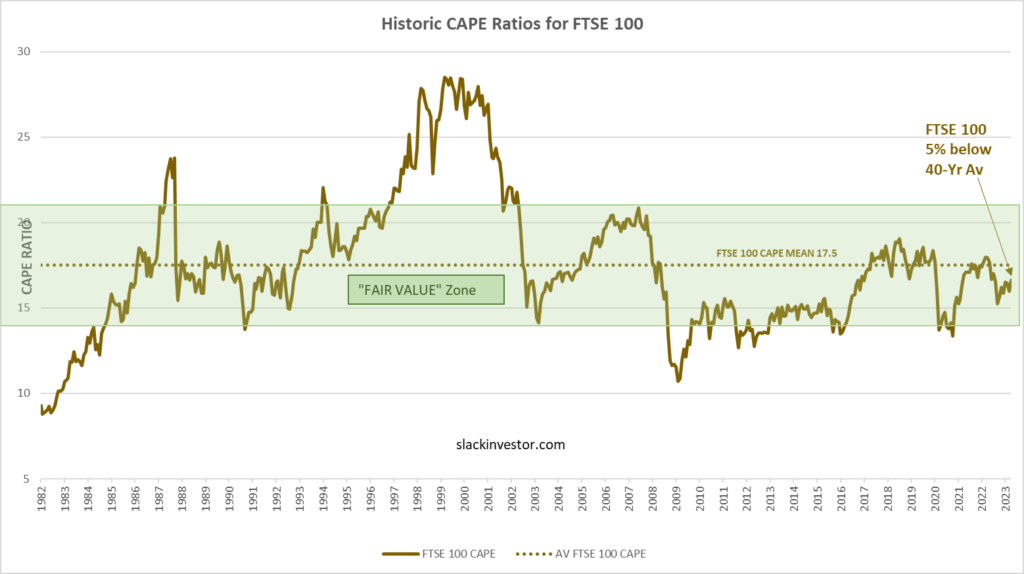

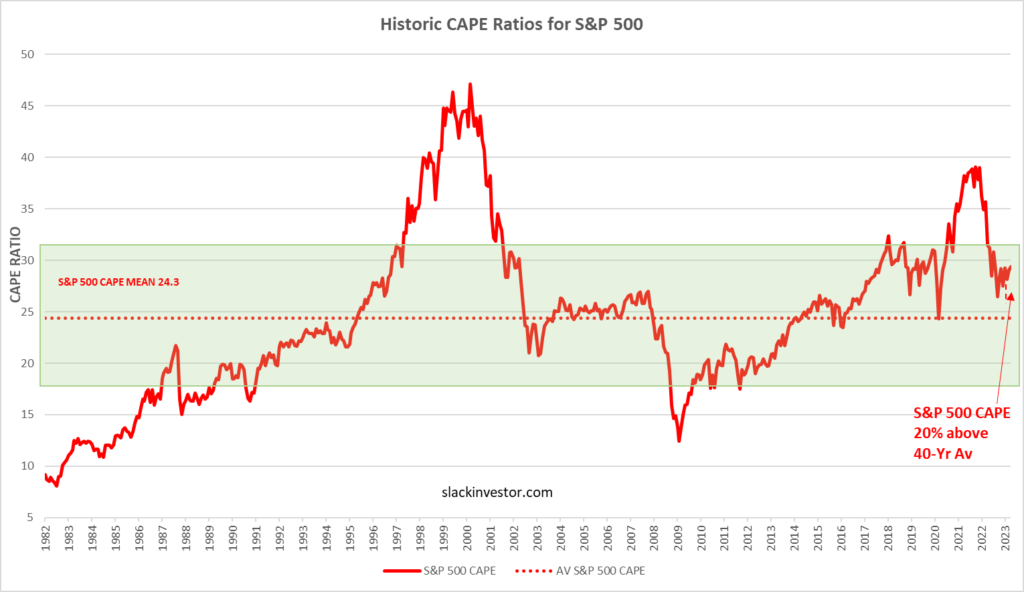

I expect a bit of volatility in my (mostly “growth”) investment portfolio and I try to reassure myself that, despite the odd negative year in the Slack Investment Portfolio the Stable Income portfolio is doing its job and keeping Slack Investor with enough cash to keep things running. In the world markets, the FTSE 100 Total Return Index was up 7.8% (last FY up 5.7%). Dividends helped the Australian Accumulation Index to be up 10.6% for the financial year (last FY -7.5%). The S&P 500 Total Return Index is again full of optimism – and was up 19.7% (last FY -10.7%) for the same period. All of these Total Return Indicies include any accumulated dividends.

Slack Portfolio Results FY 2023

All Performance results are before tax. The Slack Portfolio is Slack Investor’s investment portfolio and, after the first negative year since starting this portfolio in 2010, I am delighted to be “Back in the Black” – with an annual FY 2023 performance of +17.9%. Full yearly results with benchmarks are shown in the table below.

FY2022 was another bumper year in real estate – particularly Brisbane -but there has been a welcome pause in housing prices for FY2023. For property, the actual falls in asset values is greater than that shown as Slack Investor is using the Total Return values supplied by CoreLogic. The Total Return is calculated from value change as well as the gross rental yield. I would have preferred calculations that include the net rental yield, but this will have to do. The Total Return is a more realistic figure when comparing real estate returns to stock market total returns, as it treats both asset classes as investments.

The share market was the place to be for FY 2023, with the Australian Share market Total Return Index (ASX200 Acc) up 10.6% and the Vanguard Diversified Growth ETF (VDGR), comprising mostly (68%) of International and Australian Shares, increasing by 11.2%. Inflation is again coming in big – with the CPI at +6.0% – reinforcing the need to have exposure to “growth assets” such as shares or property.

Yearly Performance (%) results since 2010

| YEAR | SLACK FUND | MEDIAN BAL | VGARD GROWTH | ASX200Acc | RES BRIS | RES MELB | CASH | CPI |

|---|---|---|---|---|---|---|---|---|

| 2010 | 6.6 | 9.8 | 12.3 | 13.1 | 10.8 | 26.9 | 4.2 | 3.1 |

| 2011 | 2.5 | 8.7 | 9.1 | 11.7 | -2.4 | 0.9 | 4.4 | 3.7 |

| 2012 | 8.3 | 0.4 | 1.3 | -6.7 | 1.3 | -0.9 | 4.3 | 1.2 |

| 2013 | 26.5 | 14.7 | 18.6 | 22.8 | 7.7 | 8.3 | 3.2 | 2.4 |

| 2014 | 23.6 | 12.7 | 14.5 | 17.4 | 11.5 | 12.8 | 2.6 | 3.0 |

| 2015 | 2.4 | 9.6 | 11.8 | 5.7 | 7.7 | 15.6 | 2.5 | 1.5 |

| 2016 | 14.2 | 3.1 | 4.2 | 0.6 | 8.4 | 9.5 | 2.2 | 1.3 |

| 2017 | 19.5 | 8.1 | 8.8 | 14.1 | 6.5 | 17.7 | 1.9 | 1.9 |

| 2018 | 37.6 | 7.2 | 10.0 | 13.0 | 5.2 | 3.9 | 3.9 | 2.1 |

| 2019 | 19.7 | 6.2 | 9.8 | 11.5 | 1.7 | -6.0 | 2.0 | 1.3 |

| 2020 | 9.4 | 0.3 | 0.6 | -7.7 | 8.4 | 13.8 | 1.1 | -0.3 |

| 2021 | 21.7 | 13.0 | 20.3 | 27.8 | 17.9 | 10.7 | 0.2 | 3.8 |

| 2022 | -14.3 | -2.5 | -13.0 | -6.5 | 25.6 | 3.1 | 0.3 | 6.1 |

| 2023 | 17.9 | 6.9 | 11.2 | 10.6 | -4.1 | -2.6 | 2.6 | 6.0 |

The Slack Fund yearly progress vs BENCHMARKS. The Median Balanced Fund (41-60% Growth Assets), Vanguard Growth Fund, ASX 200 Accumulation Index, Corelogic Residential Property Home Value (Total Return) Index in both Brisbane and Melbourne, and Cash (Australian Super Cash Fund) and Consumer Price Index (CPI)

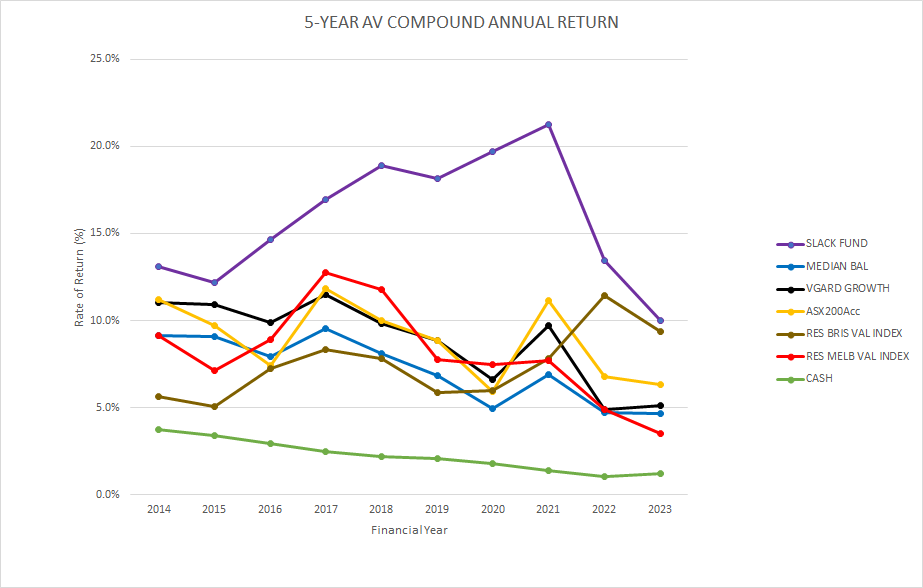

Although I collect yearly figures, the 5 and 10-year compound annual performance gives me a much better idea about how things are going and will smooth out any dud (or remarkable!) results. The Slack Fund is still ahead of Benchmarks – but currently being challenged by Brisbane Residential real estate over a five-year period.

5-yr Average Annual Performance

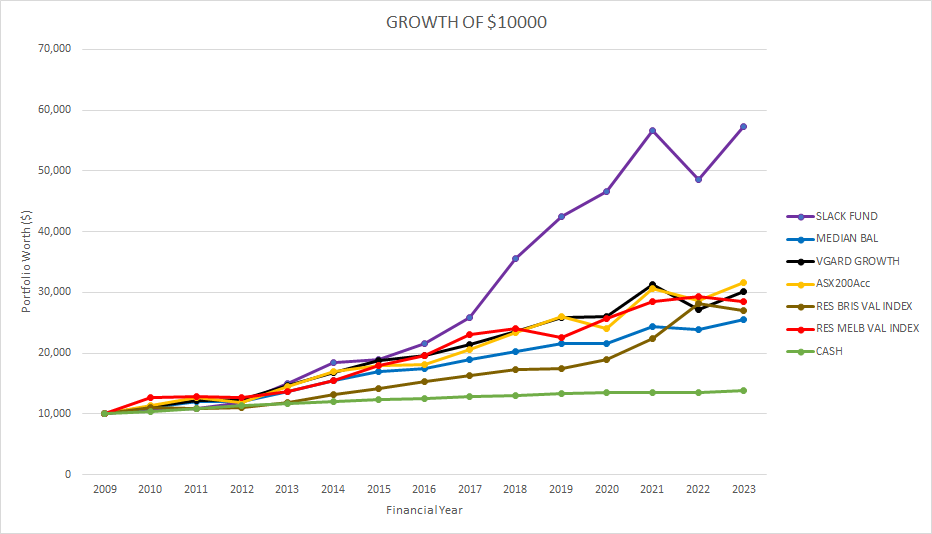

The beauty of compounding with a succession of good performance results can be seen in the chart below showing the growth of an initial investment in June 2009 of $10000.

Growth of a $10000 Investment Since 2009

10-year compound annual rate of return

The Slack Fund has been around a while and, at last, I am generating some long term data (10-year compound “rolling” annual rate of return). Over this time frame, the Slack Fund has been performing very well. A 10-year annual rate of return of over 14% – Go Slack Fund!

However, the 10-yr rates of return of the Median Balanced Fund, Vanguard Growth fund, ASX200, and residential property in Brisbane and Melbourne are also great long term investments, generating a 10-year compound annual rate of return of 6-9% p.a. From the figures below, although it can add stability to a portfolio, Cash as a long term investment, is a poor choice.

Average 10-yr compound yearly return

| YEAR | SLACK FUND | MEDIAN BAL | VGARD GROWTH | ASX200Acc | RES BRIS | RES MELB | CASH |

|---|---|---|---|---|---|---|---|

| 2019 | 15.6 | 8.0 | | 10.0 | 5.8 | 8.5 | 2.9 |

| 2020 | 15.9 | 7.0 | | 7.8 | 5.5 | 7.3 | 2.6 |

| 2021 | 17.9 | 7.4 | | 9.3 | 7.5 | 8.3 | 2.2 |

| 2022 | 15.2 | 7.1 | 8.1 | 9.3 | 9.9 | 8.7 | 1.8 |

| 2023 | 14.4 | 6.4 | 7.4 | 8.2 | 8.6 | 7.6 | 1.7 |

The Slack Fund average 10-yr compound yearly return vs BENCHMARKS. The Median Balanced Fund (41-60% Growth Assets), Vanguard Growth Fund, ASX 200 Accumulation Index, Corelogic Residential Property Home Value (Total Return) Index in both Brisbane and Melbourne, and Cash (Australian Super Cash Fund) and Consumer Price Index (CPI)