What a month! … In amongst the Christmas and New Year Celebrations, Slack Investor has been forced to get OFF the couch!

What a month! … In amongst the Christmas and New Year Celebrations, Slack Investor has been forced to get OFF the couch!

Slack Investor is on the SELL and is leaving the US, UK Index Funds – for now. He remains tentatively IN for Australian index shares – ASX 200.

Trumpishness and Brexit, future US rate rises, and stock valuations in the US add to the uncertainty and wild fluctuations. The FTSE 100 is down 3.6% and S&P 500 is down a whopping 9.2% for the month. Time to sit things out and wait for the next uptrend in the markets. It is always sad to see the end of a long successful trade and the run in the US S&P 500 has yielded 153.8% over 9 1/2 years. In Australia … we would call this a great innings and clap the US Index off the field … A fantastic Bull Run!

My efforts with the FTSE 100 are far less spectacular with an overall loss of 7.4% – However, I am glad to be out of that market with all of the Brexit confusion.

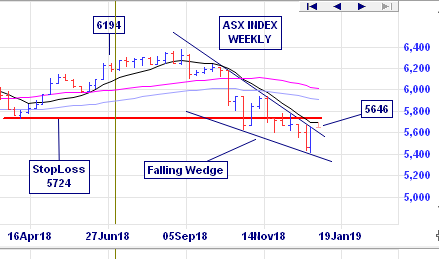

The Australian ASX 200 had a reprieve after passing through its stop loss last month, but it is still hanging in there. As the share price is still below its stop loss, I was ready to let it go this month. However, a “Bullish” pattern emerged on the weekly chart.

The Falling Wedge

The “Falling Wedge” is a classic part of Technical analysis … it can be “Bullish” (Reversing the downtrend) or “Bearish” (Continuing the downtrend)- depending on what happens with a breakout of this pattern.

The weekly chart above shows a distinct breakout from the “falling wedge” pattern (Labelled 5646). This MAY indicate a reversal of the downtrend. The ASX 200 Index is now on a weekly watch and if the share price falls back into the “wedge” at the end of the week, I will put out a post and exit the stock.

The recent price plunges have made for a dismal calendar year 2018 for stocks. Without including dividends, ASX 200 -6.9%; FTSE 100 -12.5%; and the S&P 500 -6.2%.

I naturally hope for a change in trends and wish a prosperous New Year to you all.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). I will update my portfolio holdings page in the next few days.