Slack Investor remains IN for US, UK, and Australian index shares.

Slack Investor remains IN for US, UK, and Australian index shares.

… some monthly setbacks for the Australian Index (-0.5%) and the UK index (-2.0%). However, confidence remains high in the USA with another huge (I mean … It’s like … Really Huge!) rise of 5.6% – This is “irrational exuberance” territory!

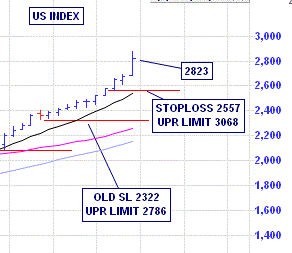

Slack Investor gets off the couch and is on alert for the US Market. The two strong rises over the last two months have pushed the S&P 500 up to breach the the 20-25% upper limit from his previous stop loss. This involves some necessary action – finding a new stop loss that is a little closer to the current price.

The old S&P 500 upper limit of 2786 was surpassed by the end of month price (2823). I then go back to the charts and find a new, higher stop loss that makes sense to me. This is usually a new “higher low” – and I had to look at the weekly charts to find a sensible stop loss minimum at 2557. If this chart stuff interests you, go back to an earlier post. Otherwise, be happy that Slack Investor has moved his stop loss upward and is ready for the inevitable fall (Correction) in the US markets.

A2 Milk Company (A2M)

Slack Investor was blissfully unaware that there are two types of proteins in Milk – Conveniently labelled A1 and A2 – Who knew?? I am blissfully unaware about most things.

A2M is a New Zealand company listed on the Australian Stock Exchange and they own the patent for identifying cows that only produce the A2 protein in their milk. The selling point, backed up with a slick marketing campaign “Enjoy Milk Again “, is that there is evidence to suggest milk containing just the A2 protein is easier for some people to digest.

Slack Investor has been an owner of this fantastic company since last year and has taken the opportunity to top up his holding when A2M reached a new high in the middle of the month at around $8.00 – This is not advice.

There are many claims for A2 Milk, including that the lactose intolerant folk find it easier to digest than normal milk. Slack Investor has had a glance at A2M’s supporting 100 independent studies and he is refreshingly skeptical of these claims till a large sample, “double blind”, piece of research emerges. There are also other skeptics.

However, he cannot argue with success of A2M’s new campaign and the converts to A2M’s products that are reflected in recent sales growth. The action on the price charts and projected sales get me off the couch. Particularly with a recent announcement that A2M is expanding into the large US market. Suprisingly (for me!), 70 percent of African Americans and 90 percent of Asian Americans are lactose intolerant.

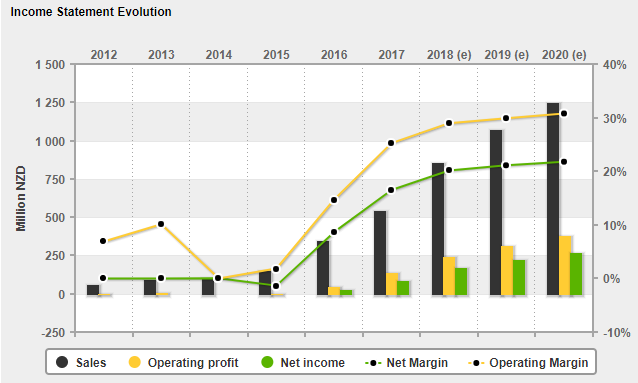

Always, before I invest, I want a deep look at a company – I use the excellent 4-Traders site and, in particular, the Financials tab – for A2M has revealed the type of growth trend that Slack Investor likes – the black columns are projected sales through to 2020. Projected increasing sales and income are the type of thing that I am looking for.

From 4-traders.com – click image for better resolution

From 4-traders.com – click image for better resolution

A2M’s Current Price to Earnings ratio is an “eye watering” very high 48. This does not compare favourably with the ASX average PE of around 15. A high PE ratio can be a sign of an overpriced stock- but there are exceptions!

The exceptions are made for exceptional companies. A2M is growing its earnings so fast that the forecast PE is much more reasonable in a few years (i.e. A2M estimated PE is a more reasonable 28 in 2019) and A2M is the type of company that is excellent at using its resources to make money – an extremely high Return on Equity (ROE ~50%). These high PE, high growth companies make up a large portion of Slack Investor’s portfolio. They can be a wild ride … as they are often punished (price drops) if they do not meet forecast earnings during reporting season – but I am happy to hang onto this company for now – there might even be some further A2M good news ahead – If not, my monthly stop loss at $6.97, and diversification, will protect me from catastrophe.

All Index pages and charts have been updated to reflect the monthly changes – (ASX, UK, US).