“If you can follow only one bit of data, follow the earnings — assuming the company in question has earnings. … What the stock price does today, tomorrow, or next week is only a distraction.”

Peter Lynch, One Up On Wall Street:

The great investor Peter Lynch had plenty of “solid gold” insights that Slack Investor has tried to incorporate into his investing. I have long extolled the virtues of growing companies with high Return on Equity (ROE). But, before I invest, I look at the earnings and projected earnings of each company at an aggregate site such as the most excellent Market Screener – Registration is free!

For example, the current market darling Afterpay (APT) is an excellent business idea and has performed extremely well for those who own it (Up 163% FY2020). APT may be a very successful company – but it is not expected to have positive earnings till 2022. From the earnings table below, both Slack Investor and Peter Lynch would be reluctant to stump up $66 to earn $0.28 in 2022.

| June FY EPS | 2017 – | 2018 -$0.04 | 2019 -$0.18 | 2020 -$0.16 | 2021 -$0.01 | 2022 $0.28 |

Slack Investor tries to get things “mostly right” and fills his portfolio with companies that Peter Lynch would hopefully approve of – There are no Afterpay’s, but many other growing companies that have an established earnings record – There will probably be some temporary downgrades to earnings in the Slack Portfolio this year due to the virus. I could never match Peter Lynch’s legendary performance, where he grew his Magellan Investment Fund from 1977 until 1990, at an average 29.2% annual return – roughly twice the gains of the S&P 500 at the time.

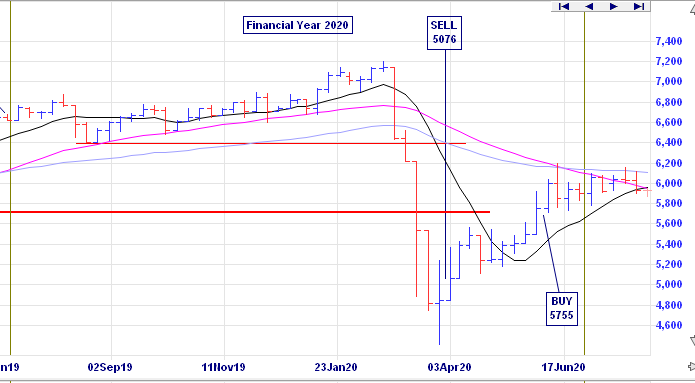

Things were going along swimmingly for FY 2020 till mid-February and the rapid spread of COVID 19 around the world. For FY 2020, the worst performing followed index was the UK, with the FTSE 100 Total Return Index down 13.8%. Dividends helped the Australian Accumulation Index to be down 3.7% for the financial year. These Americans really believe in their stock’s ability to keep earning during this recession (maybe Slack Investor has a twinge of doubt here) … the S&P 500 Total Return Index was UP 12.0% for the same period. All of these Total Return Indexes include any accumulated dividends, wheras the chart below of the ASX 200, just shows stock prices.

Slack Portfolio Results FY 2020

Slack Investor has three financial pillars to keep himself steady. I will expand on these in a later post.

- House – Home ownership gives me great security and pleasure. The bank owned most of this 30 years ago – but now I have the upper hand! (~30% of Net Worth)

- Income – This used to be my job, but in retirement I have some stable income annuity style investment (~20% of Net Worth) that would pay my bills and maintain a basic Slack Lifestyle should Armageddon befall the stock markets for a few years. This income is supplemented by income from the Slack Portfolio.

- Slack Portfolio Investments – (~50% of Net Worth) – Now currently in my Self Managed Super fund (SMSF) which is almost exclusively invested in growth companies. These are great businesses to be invested in if you have a long time horizon – as stock prices can be volatile in high Return on Equity (ROE) shares. I am currently retired and would not rely on the Slack Portfolio for stable income. Because of the stability of my other two pillars, I can be quite aggressive in the allocation of my investments in the Slack Portfolio – as I know I will not have to panic sell (for income) during any downturn.

All Performance results are before tax, given the circumstances, the Slack Portfolio annual FY 2020 performance of +9.4% was a pretty good result. Full yearly results with benchmarks are shown in the table below. A mediocre year for all benchmarks exposed to Australian and UK share markets (Median Balance Fund +0.3%, Vanguard Growth Fund +0.6%, ASX 200 Accumulation -2.7%). Real Estate was a good investment in the Brisbane and Melbourne markets for FY 2020 (+8.4% and +13.8%) – but the winds for these investments are blowing the wrong way now.

| YEAR | SLACK FUND | MEDIAN BAL | VGARD GROWTH | ASX200Acc | RES BRIS | RES MELB | CASH | CPI |

|---|---|---|---|---|---|---|---|---|

| 2010 | 6.6 | 9.8 | 12.3 | 13.1 | 10.8 | 26.9 | 4.2 | 3.1 |

| 2011 | 2.5 | 8.7 | 9.1 | 11.7 | -2.4 | 0.9 | 4.4 | 3.7 |

| 2012 | 8.3 | 0.4 | 1.3 | -6.7 | 1.3 | -0.9 | 4.3 | 1.2 |

| 2013 | 26.5 | 14.7 | 18.6 | 22.8 | 7.7 | 8.3 | 3.2 | 2.4 |

| 2014 | 23.6 | 12.7 | 14.5 | 17.4 | 11.5 | 12.8 | 2.6 | 3.0 |

| 2015 | 2.4 | 9.6 | 11.8 | 5.7 | 7.7 | 15.6 | 2.5 | 1.5 |

| 2016 | 14.2 | 2.8 | 4.2 | 0.6 | 8.4 | 9.5 | 2.2 | 1.3 |

| 2017 | 19.5 | 10.4 | 8.8 | 14.1 | 6.5 | 17.7 | 1.9 | 1.9 |

| 2018 | 37.6 | 9.2 | 10.0 | 13.0 | 1.1 | 5.2 | 3.9 | 2.1 |

| 2019 | 19.7 | 7.2 | 9.8 | 11.2 | 1.7 | -6.0 | 2.0 | 1.3 |

| 2020 | 9.4 | 0.3 | 0.6 | -2.7 | 8.4 | 13.8 | 1.1 | -0.3 |

The Slack Fund yearly progress vs BENCHMARKS. The Median Balanced Fund (41-60% Growth Assets), Vanguard Growth Fund, ASX 200 Accumulation Index, Corelogic Residential Property total return in both Brisbane and Melbourne, and Cash (Australian Super Cash Fund) and Consumer Price Index (CPI)

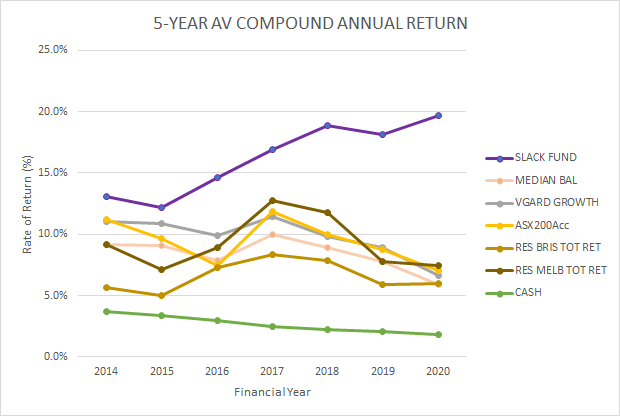

The Five-year compound annual performance gives me a much better idea about how things are going and will smooth out any dud (or remarkable!) results.

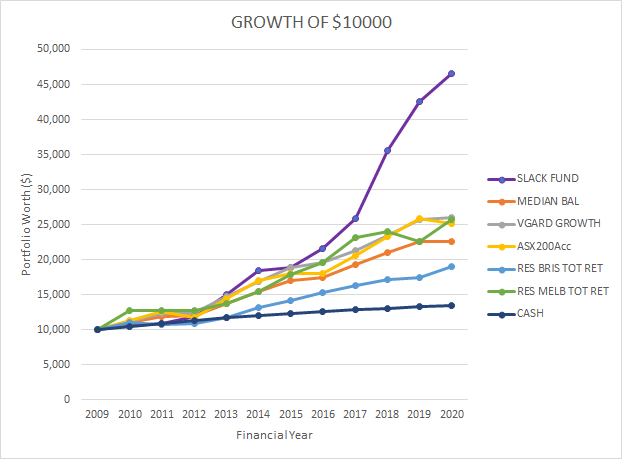

The beauty of compounding with a succession of good performance results can be seen in the chart below showing the growth of an initial investment in June 2009 of $10000.

FY 2021 Resolutions

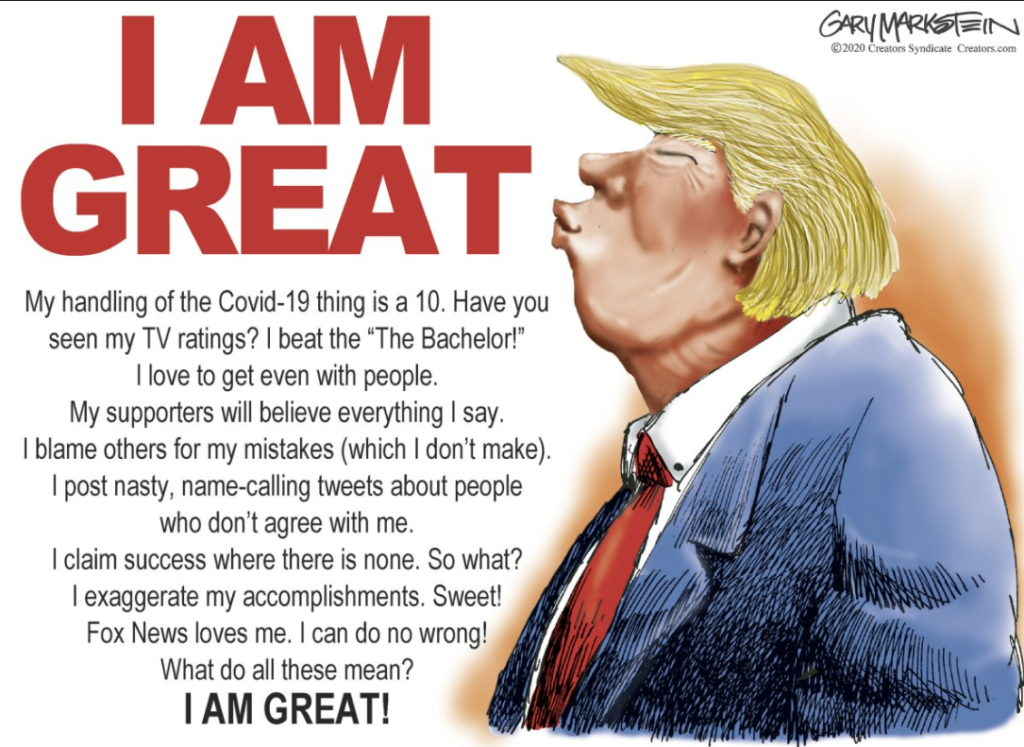

The delusional President Trump provides many lessons to Slack Investor. The absence of these traits in Trump reminds me that humility and compassion are such worthwhile qualities. I will continue to work on these personal attributes this coming financial year and always be grateful for good fortune. I made plenty of mistakes this year and in hindsight sold some shares just before a decent price rise (e.g, IRI, CIP, VGE) – but Slack Investor accepts this as just the “normal path” of investing.

Slack Investor has no form in trying to predict the future … In the last 6 months I have tinkered with the Slack Portfolio and tried to get rid of any companies that would suffer severe setbacks in this COVID-19 led global recession. I have no great faith in my ability to time the exit and entry of exposure to sharemarkets, and I remain fully invested. Slack Investor is prepared to “ride this one out” with cash in the Portfolio at less than 1%.

In the wise words of Peter Lynch …

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves.”

Peter Lynch, One Up On Wall Street: