Apologies for the late post this month – just returned from holidays. Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. The Slack Investor followed overseas markets had strong monthly rises. The FTSE100 (+2.7%) probably due to the resolution of the British Election; and the S&P500 (+2.9%) had good employment data and their economy is going OK. I add these comments as a bit of mindless speculation in hindsight. The ASX200 (-2.4%) did not do so well in December … not sure why … but (please insert your own reason here). Might be what the great leg-spinner Shane Warne calls “Natural Variation”.

The Federal Reserve bank of Cleveland have the probability of a US recession within the next year at 27.0%. This has been steadily reducing since a peak at 41% four months ago. The current value exceeds the Slack Investor threshold of 20% and my monthly stop losses for Index funds are still “switched ON”

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index) and the quarterly updates to the Slack Portfolio are also recalculated.

The ‘Twenty Tens’s – You should have been here!

This was quite a decade with lots of stuff happening. Popular Mechanics has identified 10 bad trends that have developed since 2010. Number one of their list of things we want to leave behind is “Science Denial” A perplexing trend that is encouraged by the internet and the desire to find “news” sources that reflect your own opinions. Slack investor would hope the 2020’s see a return to rationality – but is not too optimistic.

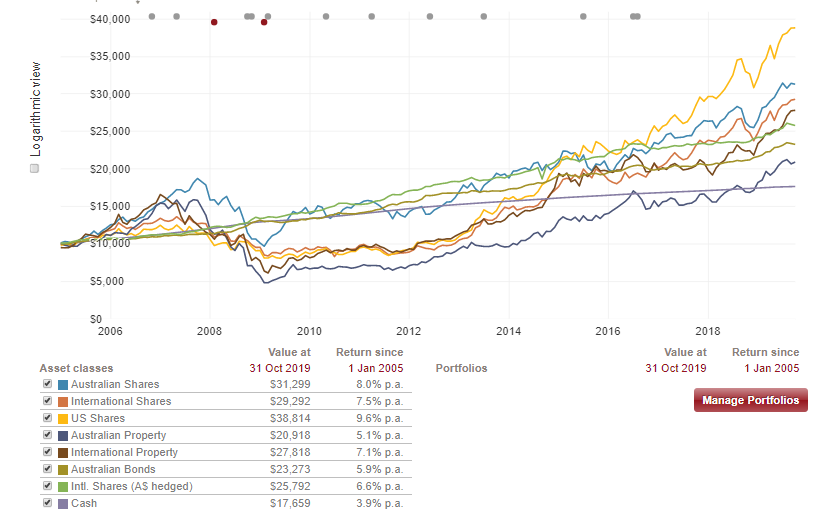

On the investing scene, the 2010’s were a great time to own assets. After the GFC in 2008/9 there has been a substantial return on most asset classes. This has been led by the US Market which used to be known as the “nation of ideas”

The US economy is still going OK, but they have been encouraged by the historical low interest rates and tax cuts. The US (and most other developed countries) has recently lapsed into political tribalism. There has also been Trump’s sanctions on world trade. In the background, there has been a change in the balance of world growth. In terms of global growth, China, India, Indonesia, Russia and Brazil will account for over half of all global growth through to 2024.

It has been a great investment decade but there are always economic cycles and shifts in world economic balance. The 2019 calendar year has also been a beauty – more on this next post. Slack Investor remains on board the investment train … but cautious.