Slack Investor doesn’t face such vexed issues as this poor young woman. In this sad, but beautifully painted, scene from the 16th Century there are two suitors – the old bearded one offering wealth in a jewellery box, while the young musician offers only love. Her gaze is turned away from both men and she has a despondent expression that suggests that the decision may not be hers alone.

My decisions seem feeble in comparison to the young girl depicted by Bouguereau. Looking at this painting just reinforces to me that men must do a better job of recognizing some of the often horrible decisions that women have to make. Sure, things have improved for women since the 16th Century – but there is still plenty of inequalities. It is the duty of all men to “lean in” and try to make things better.

Asset Allocation Decisions before the end of the financial year

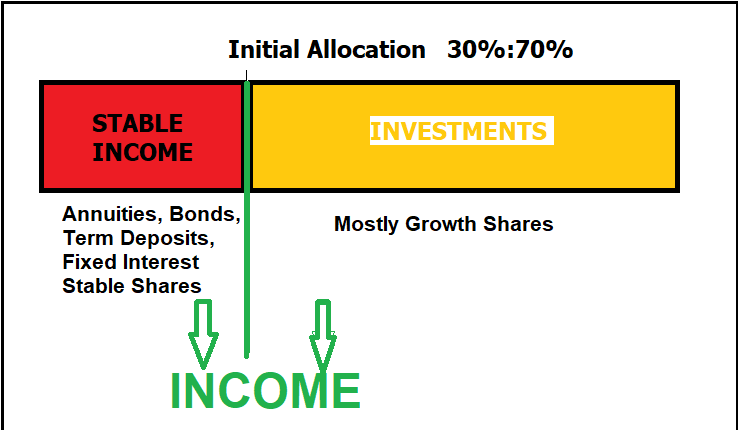

Slack Investor likes to have a look at my income producing piles at this time of year – The Stable Income pile and the Investments pile. I have to decide how to allocate money for living expenses and how to allocate the amounts in my investment asset mix before financial year end to get it ready for next year.

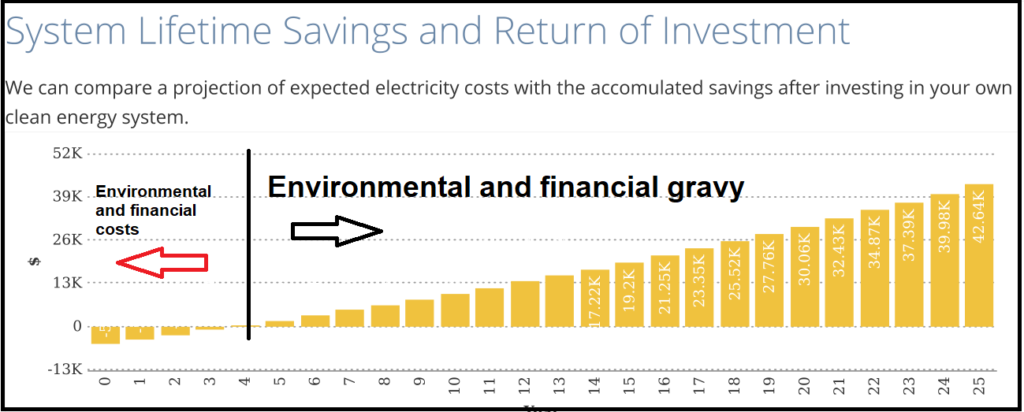

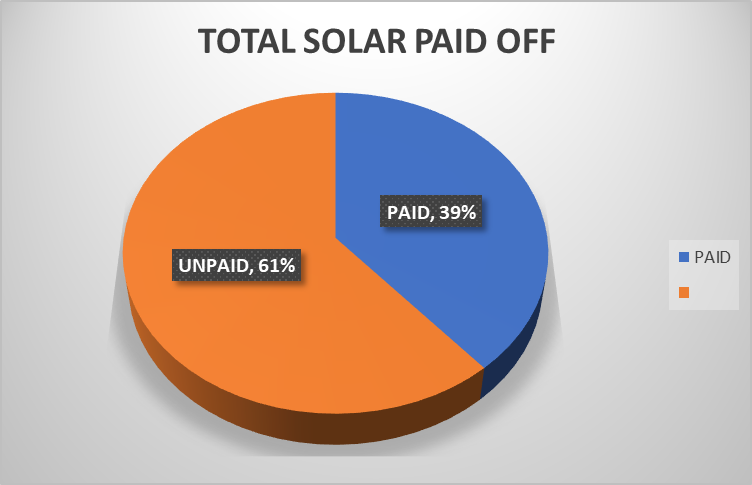

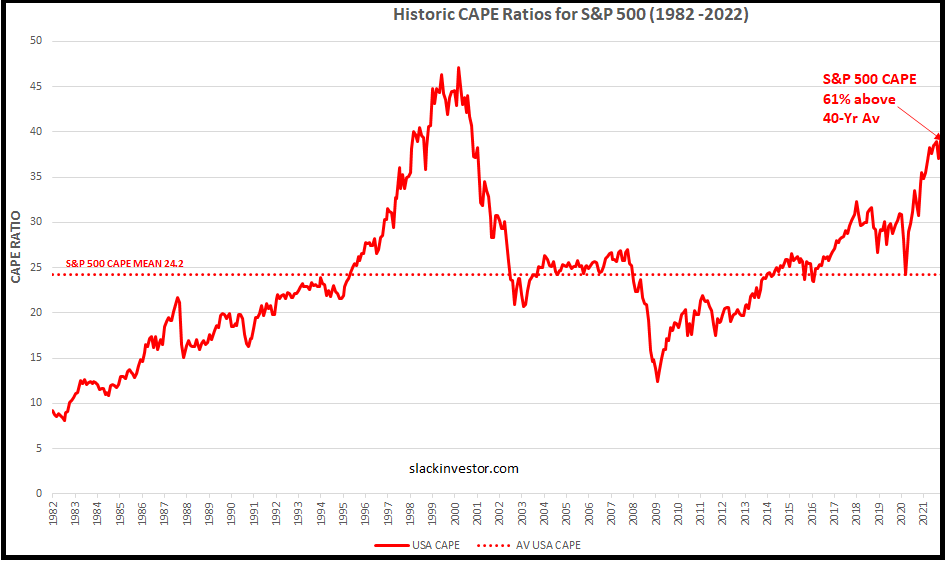

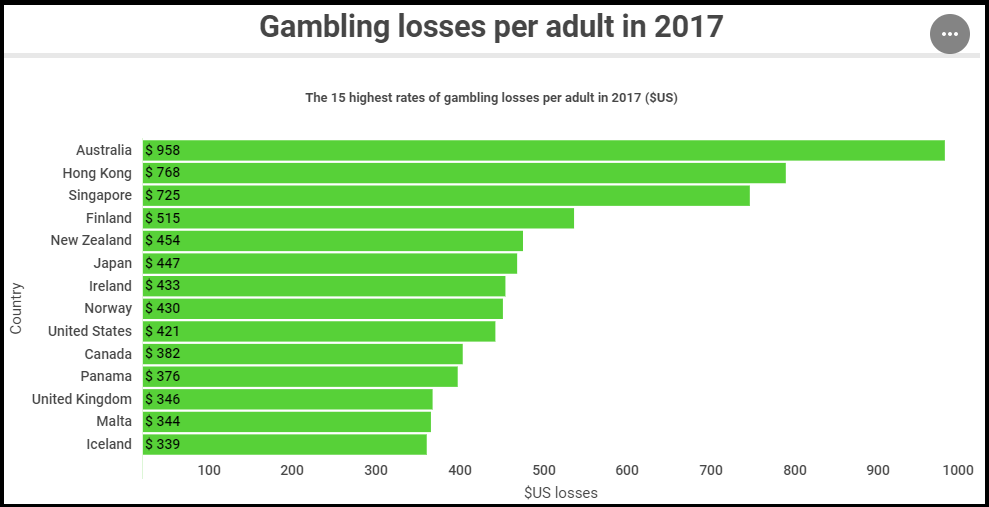

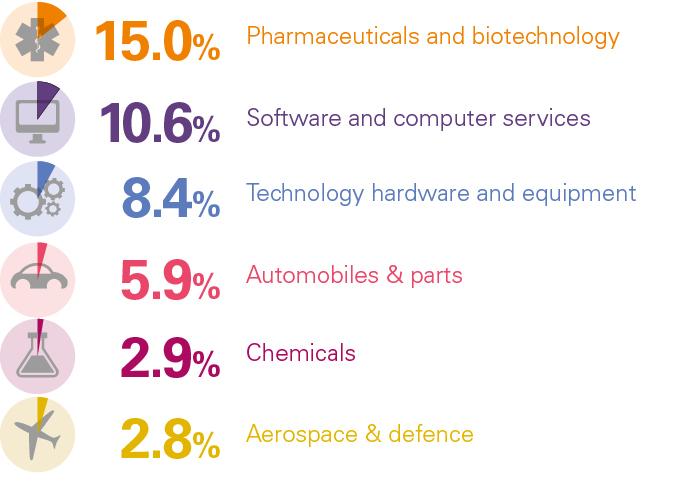

Lets just back track a bit here and remember that Slack Investor finances were thrown into three piles before retirement– a House, Stable Income, and Investments. Now that I am retired and fortunately have my house paid off, there are only two piles that really concern me – The Stable Income pile (30 %) consists of Annuities, Bonds, Term Deposits and Fixed Interest. I have recently added some shares to this pile that I think won’t be too affected by a share market downturn. This share tranche consisting of a small amount of property trusts, consumer staples and infrastructure shares.

The other pile is Investments (70%)- consists of mostly growth shares (high Return on Equity, historical and forward earnings growth).

Despite the tough recent times for growth shares, after extracting living expenses, the total of the piles has grown slightly so far this financial year (0.2%). With 70% growth shares, positive pile growth will not always be the case. But my asset allocation strategy should help be ride out the bad times.

Dividend season is almost over and throughout the financial year I have taken out most of my living expenses from both piles using income from annuities, interest payments, distributions and dividends. At this stage, my current allocation is 29% Stable Income and 71% Investments. In order to maintain my 30%:70% asset allocation, if I need anymore living expenses I will take it out of my over-allocated Investments pile. I will make final adjustments at the end of the financial year – so that the initial allocations are roughly intact (30%:70%) – ready for the next year.

The decisions I make on asset allocation are to keep my nest egg in good shape – so that it continues to provide income. In a good year for investments most of my living expenses can be withdrawn from the Investments pile. In a bad year for investments, then I dip more into the Stable Income pile. Also, in a bad investments year, I might cut back on my discretionary expenses eg. Travel.

March 2022 – End of Month Update

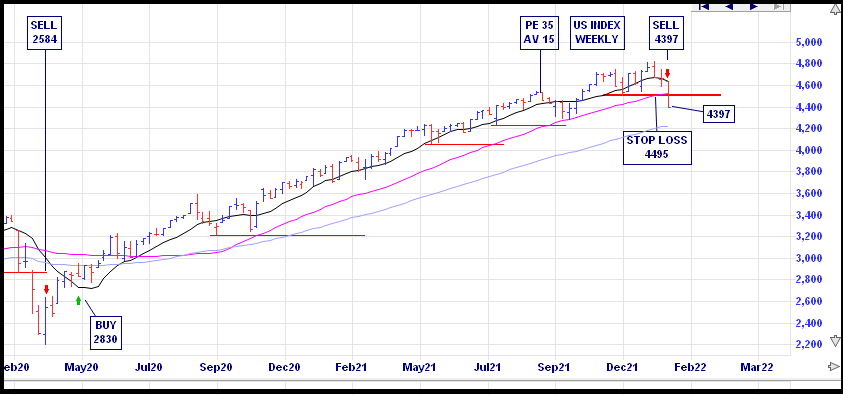

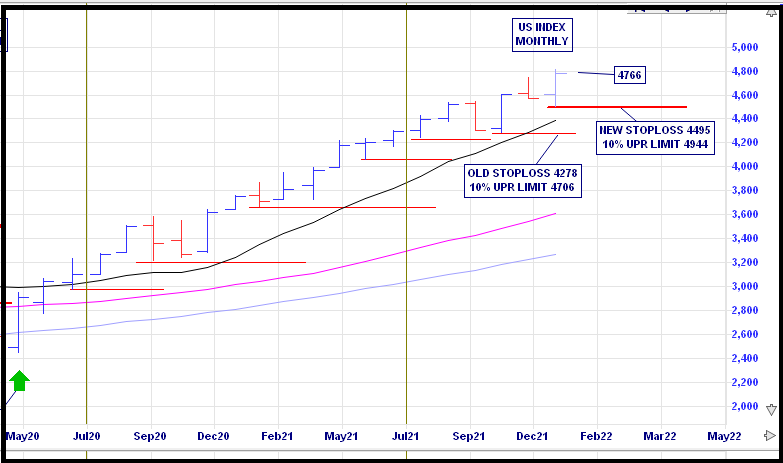

Slack Investor remains IN for Australian index shares and the FTSE 100 but OUT for the US Index S&P 500 due to a sell in January 2022.

The FTSE 100 was flat this month (+0.4%). There were substantial rises for the ASX 200 (+6.4%) and the S&P 500 (+3.6%).

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). The quarterly updates to the Slack Portfolio have also been completed.