Slack Investor has always been on the “glass half full” side of life – but acknowledges the decided benefits of pessimism.

The nice part about being a pessimist is that you are constantly being either proven right or pleasantly surprised.

George F. Will – from source

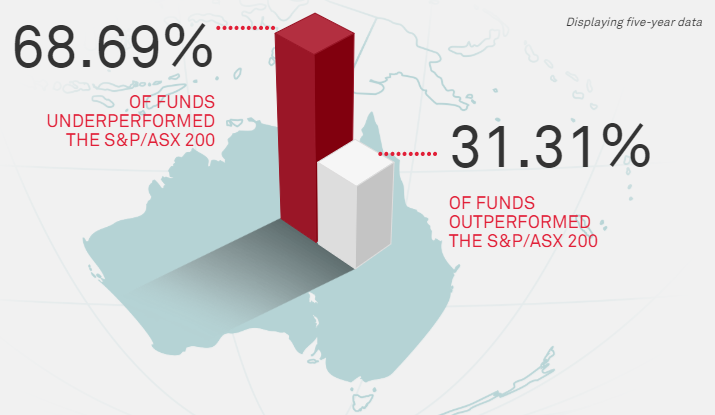

Slack Investor would much rather hold shares than not … and be involved with companies that are growing and part of the economy than using more passive investments such as cash. However, he must keep his eyes open occasionally – and keep a watch on major market trends.

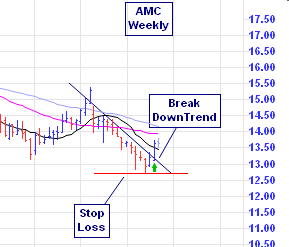

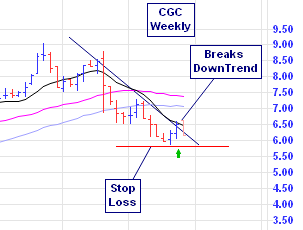

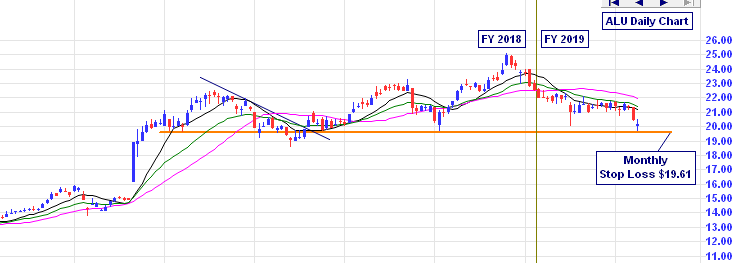

Let’s firstly have a look at the markets that Slack Investor is involved in. The ASX200, FTSE100 and S&P500 are all in a distinctive downtrend. Typical is the ASX200 weekly chart shown above. This downtrend may go further but Slack Investor is seeing some signs for optimism – At least in the Australian market.

There is a high level of uncertainty in global markets at present. Europe has Brexit and Italy. The US has investigations into Donald Trump’s election campaign. China has the threat of a trade war with the US. But my sense is that the market has become risk averse rather than fearful. There is no sign of panic selling as yet. But investors are clearly on the defensive and prepared to sell off vulnerable stocks.

Colin Twiggs – Trading Diary

But, all is not lost … Despite large amounts of emotion in the market. The fundamentals of emerging economies are still good. Vanguard estimates that a recession in 2019 is not likely – that the more likely scenario is a slowdown in growth, led by the U.S. and China.

Shane Oliver, head of investment strategy at AMP Capital, said “history tells us” a major bear market requires a recession in the U.S., but that is not happening. He advises that U.S. monetary conditions are “far from tight,” with fiscal stimulus still in play and no signs of excessive market conditions that normally precede a recession.

Marcus Padley is also on on the side of the optimists and concludes that the current situation in the ASX is more of an opportunity than a disaster. He notes that average correction for Australian markets is 13.72% and takes 109 days. The current correction has been 13.2% and it has taken 59 days -Brutal! On that basis, we have already completed an average correction in half the usual time. These corrections are never fun and test even the most strident of investor. But Slack Investor IS an investor much more than he is a trader.

Slack Investor has already had a hard look at his portfolio … and said goodbye to some … and is hanging on to most – as he thinks that most of his individual shares represent reasonable value at current prices. I’m sitting tight for now with a bit of cash in the bank should things turn around, Sadly, more decisions will have to be made at the end of the month – but for now, I am grateful for the good things in life … Happy Christmas to you all.