Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. The ASX probably had a bit of catching up to do and put in a big month (+5.0%) – These type of rises make Slack Investor nervous! There was also an opportunity to revise upward the stop loss for the ASX 200. When the share price gets to be 20-25% above a stop loss on the monthly charts, I usually look for a sensible place to put a new stop loss at a higher value. The ASX 200 is still in an uptrend – and a “Higher Low” had been established at 6396 on the monthly chart. The Stop Loss was moved upward to 6396.

The FTSE100 (-3.4%) lost last month gains and the S&P500 was flat at (-0.2%). Both are still well above monthly stop loss levels.

The Federal Reserve bank of Cleveland have the probability of a US recession within the next year at 25.9%. There has been not much change in the past 3 months. There was a peak at 41% five months ago. The current value exceeds the Slack Investor threshold of 20% and my monthly stop losses for Index funds are still “switched ON”

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).

The introduction and growth of Australian Super

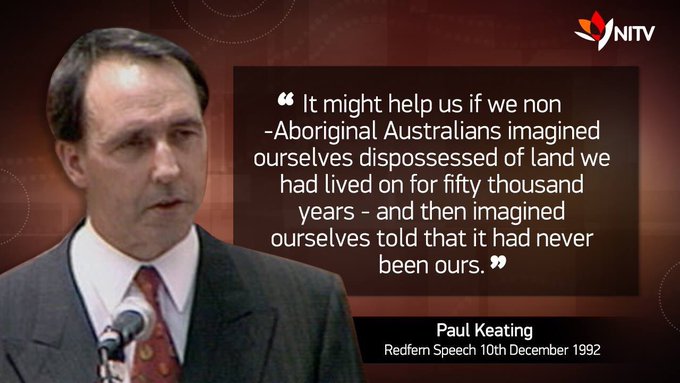

Not really a fan of insulting language but sometimes it is necessary to cut through, and Paul Keating was a master of this art. Imagine what it was like back in 1991 – where Keating, with the help of Trade Union Leader Bill Kelty, was able to convince Australian unions and workers that an overdue 3% pay rise should go into compulsory savings. Instead of going into worker’s pockets, he argued that the payrise should go into a retirement scheme called “superannuation”. ABC economist Peter Martin describes this incredible feat of persuasion as a means to avoid inflation at a critical time in Australia’s economy.

The most excellent compulsory Australian super has been going since 1992, accounts for 9.5% of workers income, and now stands at 2.9 trillion AUD . According to ASFA, Australia is the 4th largest holder of pension fund assets in the world. But the Productivity commission says that super fees are still to high and that some super funds are duds. For most of your working life, you should be in a “growth” fund that is not a dud!. The Chant West compiled funds below have an excellent track record over 10 years – a good place to start.

New Australia Day please

In contrast to many current day politicians, Paul Keating was a real leader, prepared to argue the case for a proposal – even if it wasn’t initially popular.

Australia Day is currently celebrated on January 26th – The anniversary of when Captain Arthur Phillip took formal possession of the colony of New South Wales in 1788. This date does not sit well with many indigenous people who understandably see this as a commemoration of “invasion day”. It is time for a new date! – the anniversary of the opening of the first Federal Parliament in Melbourne, 9 May 1901 has been suggested.

May might be a bit cold though. Noel Pearson suggests the more inclusive celebration of both the 25th and 26th of January. The first day a recognition of the 65 000 years that indigenous Australians occupied the land – and a putting to bed the false idea of “Terra Nullius”. The second day, a celebration of modern Australia.

Nice work Noel … I am sure Paul Keating would approve – and two holidays instead of one … very Australian.