Apologies to my faithful email subscribers, two days ago an unfinished version of this post was released into the ether. Slack Investor has rudimentary skills in the blogging arts and didn’t know how to recall the post. Anyway … this is what it was supposed to look like – with all information updated!

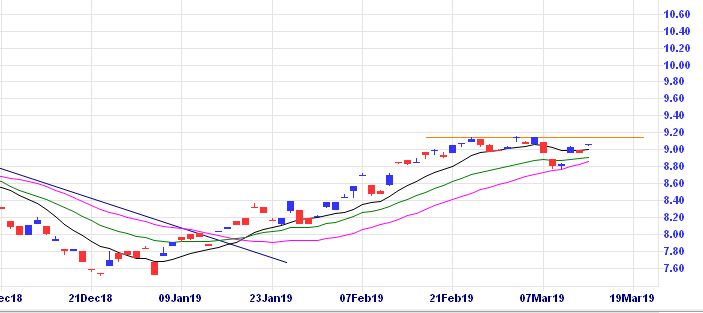

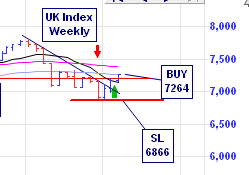

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. The Slack Investor followed overseas markets are a mixed bag with a flat ASX200 (-0.4%), and a dropping Brexit plagued FTSE100 (-2.2%). The good old US has shrugged off chants of “Lock him up” for their president and the S&P500 has had a monthly increase of 2.4%.

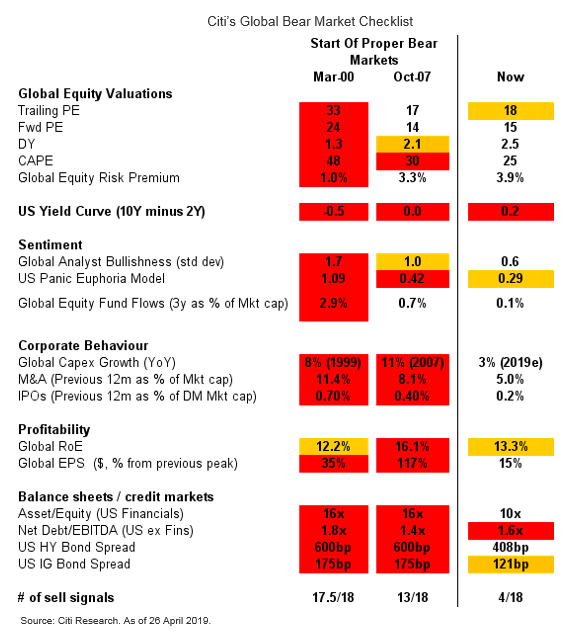

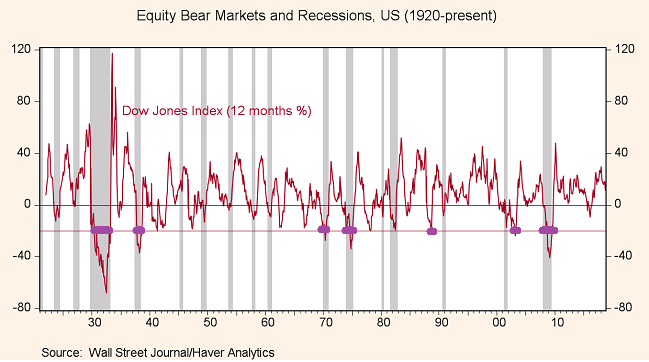

The Federal Reserve bank of Cleveland have the probability of a US recession within the next year at 31.0%, this has been gradually dropping since a peak at 41% two months ago. However, the current value exceeds the Slack Investor threshold of 20% and my monthly stop losses for Index funds are definitely “switched ON”

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).

Household debt – the couch is getting a little uncomfortable

According to 55,000 respondents to the ABC’s Australia Talks National Survey, debt is a major problem for the nation.

On an individual level, 37 per cent are struggling to pay off their own debts, with almost half of millennials reporting that debt is a problem for them personally …

Australia Talks National Survey

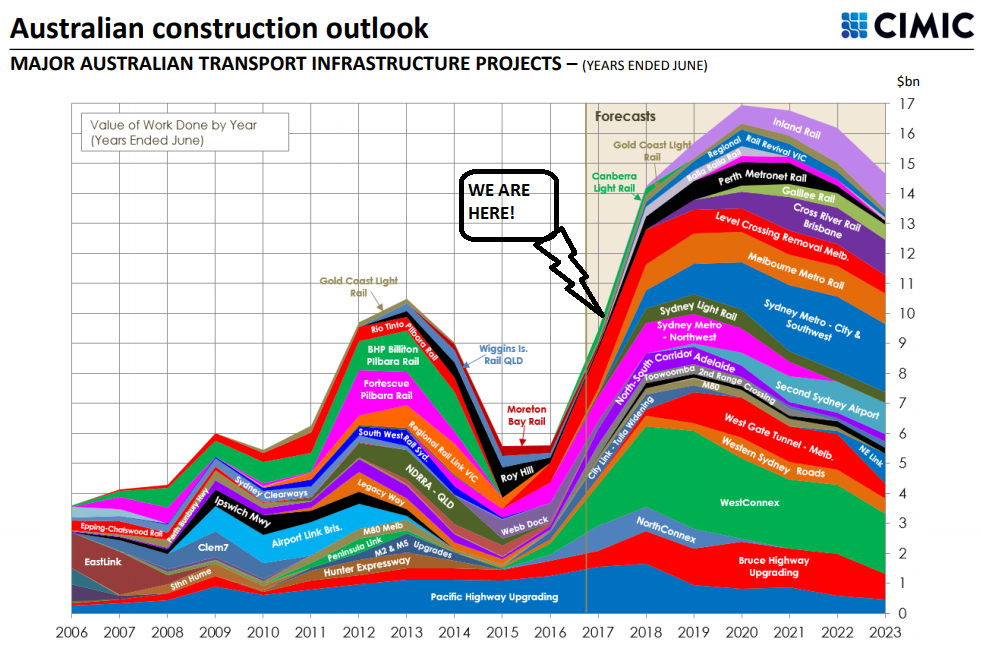

Australia may not be in the top four countries for Rugby these days but we are one of the world leaders in terms of household debt. In fact, we are second only to Switzerland. I am ashamed to say Australia’s Household Debt is world class and edging towards 200% of income. With such a big chunk of our disposable income leaking to debt, it is no wonder that recent interest rate cuts are not having much effect on the economy as Australian consumers try to tighten the belts. According to the Reserve Bank, it seems that, with stagnant wages growth, most are coping with their debt by reducing their consumption.

Basically, the Australian economy is facing a long period of sluggish demand growth as our record high household debt becomes a giant millstone around the economy’s neck.

From macrobusiness.com.au

Debt can be multi-headed with mortgage, credit card, personal loans and education components. The ME Bank survey has found that there is stress in some parts of the community. If your employment income is steady, in these reducing interest rate times, the fortunate have been able to keep up existing monthly payments to reduce overall debt. This is a good strategy. Most Australian homeowners are ahead of their payments – so there is a bit of a buffer. RBA statistics show that the average borrower is almost 36 months ahead of their required payments. Though, there are worrying signs in some households.

Of households with debt, there was an increase in the

ME Bank survey

number expecting they ‘will not be able to meet their

required minimum payments on their debt’ and ‘can just

manage to make minimum payments on their debt’ in

the next 6–12 months – 43% combined compared to

38% in December 2017.

With the number of mature-age Australians carrying mortgage debt into retirement increasing rapidly, many are intending to use a portion of their super (which was supposed to fund retirement!) to try to extinguish their debts when they retire. The ME Bank Survey found that even with compulsory superannuation, only around 18% of households expect to ‘fund retirement with their own super’ (down four points in the past six months). The proportion of households expecting to ‘use both private savings and the government pension’ increased two points to 42%.

I hope that our politicians have a plan for all of this – although, as this involves a bit of thinking beyond the next election, I doubt it!