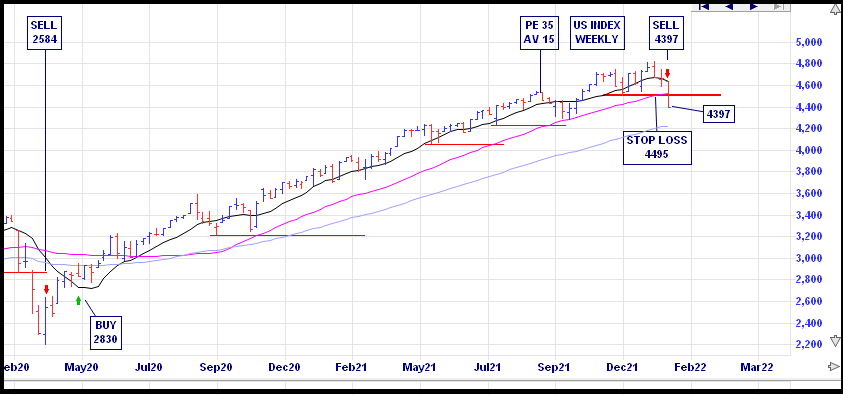

January 2022 – S&P 500 SELL Alert Update

Normally, Slack Investor likes to work on a monthly scale i.e Slack! He usually limits himself to just two posts per month – so this is an unusual post.

I have to report that I am tentatively OUT on the S&P 500 – but remain IN for Australian index shares (ASX 200) and the UK Index (FTSE 100).

Slack Investor has been a little bit on edge lately due to the high valuations of stock prices – particularly with the S&P 500. As a result, I have been working with tightened stop losses on my Index funds and tried to keep them within 10% of the latest end of week price.

Sadly, on a weekly basis, the S&P 500 has just sunk below the current stop loss of 4495 and is on a SELL watch.

S&P 500 Weekly chart since May 2020 – Incrediblecharts.com

This means that, on the US open of trade, Monday 10am (New York Time) – I will try to sell my S&P 500 Index holding. The only situation that will stop me is – if there is a dramatic reversal in the first hour of trading. In other words, if the S&P 500 starts increasing in price – I will not try to trade against the trend and I will put a hold on the selling.

A quick look at the S&P 500 futures shows a continuation of negative sentiment likely for the Monday – and it is probable that I will sell. It has been a good association with the S&P 500 since May 2020. I will give full details of the trade in the end of January update.

This is not advice – just an outline of Slack Investor’s trading intention.

What percentage of the current value will you lose to capital gains tax? Do you think that loss will be more than the potential drop? What will you do with the proceeds of the sale?

Hi Peter, Slack Investor is not really a question and answer blog – just a journal of my investing experiences and financial things that interest me. But I will attempt to answer your questions this time.

1/ Share Capital Gains Tax (CGT) in Australia is dependant on personal income, share holding time and type of ownership. If US index fund were held in my name, I estimate the CGT as 15% of the profits. As they are currently held in a pension fund. There will be no CGT.

2/ I have no idea on where the S&P 500 will end up … I only know that it has moved below my stop loss.

3/ At this stage, proceeds of sale will go into cash.