Slack Investor takes the easy way out and generally stays clear of politics … but the machinations of government often fascinate me. I have followed the development of compulsory superannuation in Australia since its inception in 1992 … so, some recent changes to Australia’s superannuation system has got me off the couch.

Your Future Your Super

Pictured above are a couple of Australian Senators with unusual pasts who have just linked up with a lesser known Senator, Stirling Griff, to help pass a significant super reform. The Your Future, Your Super Bill has just become law in June 2021 by the narrow margin of 34 votes to 30.

… the most significant change to super since its introduction in the 1990s … consumers could expect savings of more than $17 billion once it came into law.

Australian Treasurer, Josh Frydenberg – AFR

There will be a new online comparison tool for super products “YourSuper” set up by the Australian Tax Office- and a range of other changes.

Super fund to follow you

In particular, I like the stapling of funds to each employee when they get there first real job. For too long, it was the default practice to start a new super fund when you changed jobs. This led to many people having numerous super funds … and multiple sets of fees and insurance. These new laws should eliminate the problem of multiple funds. Slack Investor followers would have already engaged with their super to roll all of their super into one good performing fund. However, this measure will help those who are not as committed to their long term wealth accumulation pile.

Underperformance measures

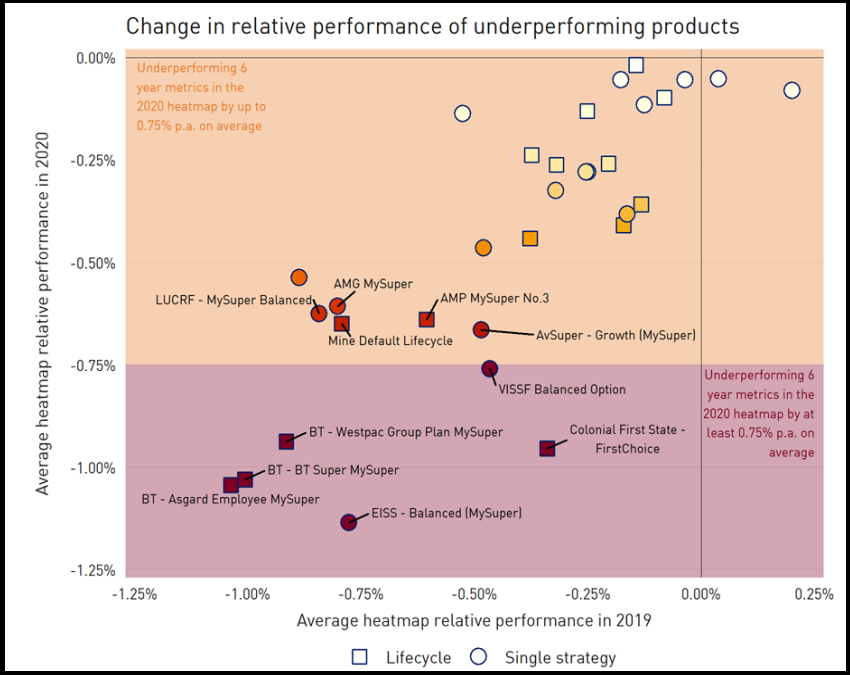

The default MySuper products will have an annual performance test. The funds that are underperforming will need to write to each member if the Australian Prudential Regulation Authority (APRA) reckons that their returns are less than the APRA benchmarks. Poorly performing funds will be assessed as unable to accept new members. An example of how APRA will pick funds for sanction is shown in their assessment of underperforming funds over 6 years in 2019 below.

Problems with Your Future Your Super

Not everyone is impressed with this new bill, the Labor party and Greens senators opposed it – the Labor opposition perhaps as it is too beholden to the whim of the Industry funds. There is also some criticism about disability insurance being in some cases industry specific and wise to staple to each industry. But, there is a parliamentary enquiry looking into this.

The underperformance measures also seem a little harsh. Average underperformance by only 0.5% will result in some APRA sanctions. Graham Hand from Firstlinks points to some better ways of managing underperformers which include a more consultative approach by APRA.

There will be some strange unintended consequences. Due to the general disengagement of the Australian public with their super – If your first super fund avoids sanctions, people will generally stay with it. As most people get their first job in retail or hospitality, this will boost industry funds such as REST and HostPlus. The AFR suggests that the Construction and Building Unions Superannuation are expected to be losers under these reforms.

Slack Investor view of the reforms … Mostly Good.

“(I do not want to) let the perfect be the enemy of the good”

Senator Jacqui Lambie unexpectedly channelling a bit of Voltaire – From AFR

June 2021 – End of Month Update

The financial year closes and looking at the 12-month charts for FY 2021 – I am surprised with the vigour of all invested markets. I am all IN for my Index funds!

Solid monthly rises for the ASX200 (+2.1%) and S&P500 (+2.2%) – The FTSE100 flat at +0.2%.

COVID-19 is still a big concern and has caused havoc across the globe – but the wheels of industry and speculation have kept on turning. Despite Slack Investor’s nervousness I remain invested for all followed markets. This is one of the strengths of a trend-following system – it helps overcome any misgivings of the frail human being. More analysis of the financial year in the next few posts.

All Index pages and charts have been updated to reflect the monthly changes – ASX Index, UK Index, US Index. The quarterly updates to the Slack Portfolio have also been recalculated.