“We all are men, in our own natures frail, and capable of our flesh; few are angels.”

William Shakespeare, Henry VIII

Yes William, we humans are weak … even Slack Investor has a few human biases that get in the way of his investing. We humans are constantly battling against traits formed deep in human past where we were hanging out in caves and each day was a battle for existence. A lot of human foibles can be explained by Evolutionary Psychology. This fascinating field of study tries to identify which human psychological characteristics have evolved. In primitive times, if we found a trait that was successful and helped our survival, then we would try to repeat it.

Anchoring Bias

Anchoring bias occurs when we put to much weight on the first bit of information that we hear. A good example of anchoring is provided by Weingarten Associates.

Do you think a porcupine has more or less than 5000 quills ?

Do you see what happened here? An “anchor” was sneakily thrown in, and potential guesses from the “porcupine uninformed” would cluster around the 5000 mark. According to Science, any well dressed porcupine will have 30 000 quills.

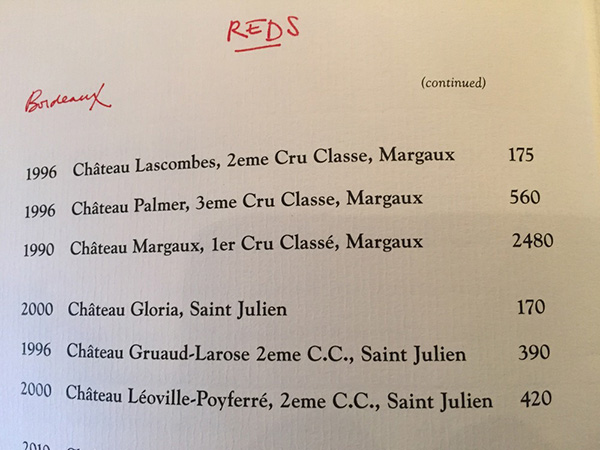

Another great example from the world of commerce that Slack Investor would fall for is provided by Stockspot. It is common for a restaurant to have an outlier as an “anchor” in the wine list to make the other wines seem like a bargain. Confronted with this list, after the heart attack, Slack Investor would probably go for the tried and true method of going for the 2nd least expensive bottle – Although tempted, I wouldn’t order the “low price” Chateau Gloria and risk being labelled cheap for the sake of 5 bucks!

Stock prices are good examples of anchors. If a share price falls from $4.00 to $2.00, it doesn’t necessarily mean that the stock is now a bargain. Neither price should act as an anchor – the stock may never return to $4.00. The important thing is the value of the share now … At the price of $2.00, is there potential for growth? – you would have to look deeper than just the stock price to answer this question.

Slack Investor has observed how share prices move like a river, sometimes in flood and ahead of their true value and sometimes in a drought – and lagging their real worth. This is a difficult lesson, but there is no logical reason to be anchored to either your buy price or a recent high or low price. If you buy a stock at a price, and it starts heading south, the price you paid should not anchor you into waiting till it returns to the buy price – this has been one of Slack Investor’s frailties in the past. Unfortunately, much of the finance press reinforces anchors with language like “down 20% from a recent high”. It is up to the investor to take a hard look sometimes and make a decision on the future prospects of all our investments.

Chasing Last years Returns

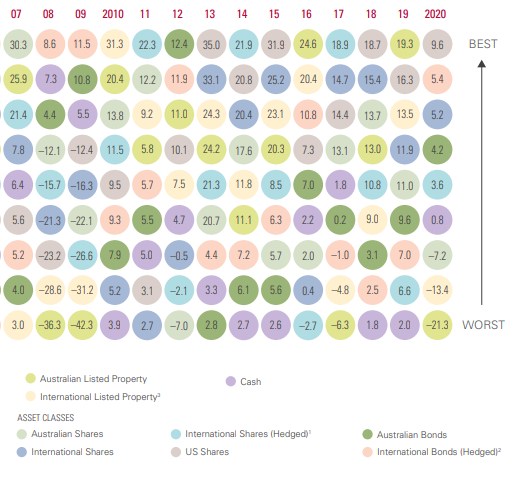

Anchoring also influences we poor humans when we are thinking about investing and confronted with fund manager, ETF, or stock performance figures from last year. It is natural to be drawn to the high performers for the previous 12 months. A look at the Vanguard chart below showing % returns for 9 different asset classes reveals how rare it is that an asset class will repeat a top performance for the next year. Most asset classes will have their “moment in the sunshine” and this adds to the argument for diversification.

This anchoring also is prevalent when choosing managed and superannuation funds. Last year’s top performers are always heavily promoted and usually attract the most new money. Retire Happy has done some fund research and concluded that chasing last years performance works about 15% of the time. Or, Slack Investor would say, a “not working rate of 85%!

The only way to combat anchoring is to be aware of it. Slack Investor always tries to be conscious of this anchoring bias prior to an investment decision. Are you giving enough thought to how the investment fits into the general economy? How is the stock looking on the charts? Have you done the fundamental analysis on the investment – looked at the projected sales, PE ratio, ROE? Or, are you basing your investment decision on an anchor point?