… Welcome to my house, Baby take control now, We can’t even slow down, We don’t like to go out, Welcome to my house …

Flo Rida “My House”

Slack Investor’s taste may not be quite as “gangsta” as Flo Rida – check out his full video to get a flavour of what I mean – But, both Flo Rida and I share a genuine passion for the joys of household ownership.

In my last post, I had a bit of a rant about the exorbitant transaction costs of buying a house. Despite the costs, I hope that I didn’t mislead about the absolute joy that Slack Investor feels about house ownership. A Slack Investor pillar for financial independence is to own your own place before you retire – as the cost of housing keeps rising for retired renters. The typical homeowner aged over 65 spends just 5% of their income on housing, this compares to nearly 30% for renters.

Flo Rida and I are enamoured with owning our surroundings:

- The Serenity – Ownership gives stability and control – You can do what you like in your own house and are immune from sudden evictions.

- Access to aged pension and taxation benefits – the home is treated differently than other assets. However, Slack Investor thinks that these concessions are too generous and will probably be capped in the future – Currently in Australia, $6 billion in pension payments go to people with homes worth more than $1 million.

- Flexibility – No need to ask the landlord to make changes – If you go on an extended adventure, then why not rent your house out for the dates that you are away – to help pay for the holiday – Or, House swap to an exotic location!

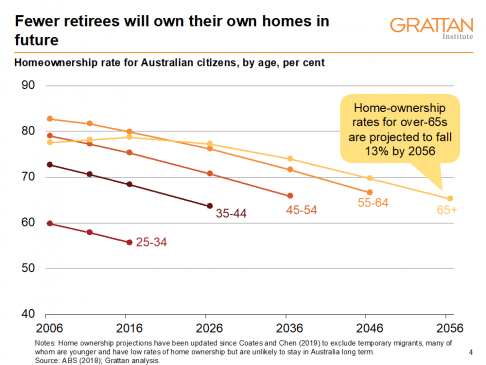

Slack Investor understands that owning a home may seem an impossible dream to some – and, sadly, ownership rates are decreasing . But do not give up hope – Many real estate pundits are expecting prices to fall from their current eye-watering levels. This fall should be accelerated by COVID-19 factors.

A home does not have to be large and, it could be out of a capital city. There seems to be a trend already for millennials (and older folk 60-69) to be moving from cities to the regions according to the Regional Australia Institute. They suggest that equitable access to housing is one of the pull factors for this move to the regions. Slack Investor has spent most of his working career outside of big cities and can highly recommend the simplicity of life away from the capitals.

More than 400,000 Australians moved from capital cities to regional destinations between 2011 and 2016

Regional Australia Institute report – February 2019

June 2020 – End of Month Update

Slack Investor admits to being only an amateur economist and finds the current situation in the US confusing – Stock market up, economy down! These are wild times … but I am back to all IN for my Index funds!

US Data keepers, the National Bureau of Economic Research (NBER) have now determined that the US economy entered a recession in February 2020 “with different characteristics and dynamics than prior recessions”. The Federal Reserve bank of Cleveland strangely have their forecast of a recession in the next year at 19.2% (below Slack Investors threshold of 20%). However, reality always beats forecasts and Slack Investor has his stop losses live again for all Index funds.

Monthly rises in all followed markets ASX200 +2.5%, FTSE100 +1.5% and S&P500 +1.8%.

COVID-19 problems go up … stock markets go up? I know stock markets are usually forward thinking and obviously see an end to COVID problems soon. Slack Investor is not so sure … but the charts have him invested in all markets. My portfolio is trimmed to industries that should be OK( I Hope?)

All Index pages and charts have been updated to reflect the monthly changes – ASX Index, UK Index, US Index. The quarterly updates to the Slack Portfolio have also been recalculated.

Nice One SI!