Slack Investor remains IN for US, UK, and Australian index shares.

Slack Investor remains IN for US, UK, and Australian index shares.

A steady month for the ASX and gains for the UK market (0.7%) and the US Market (2.3%) – It must be the “Mooch” Effect. I am sad to see him go … In a circus you need heaps of clowns!

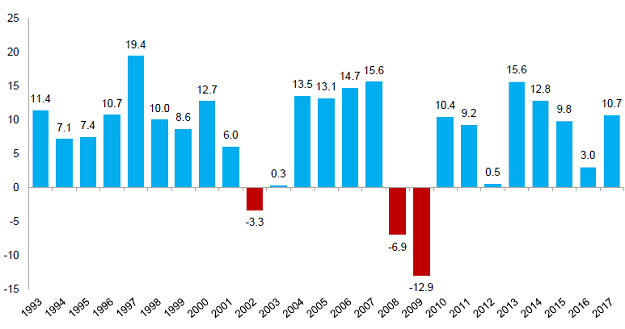

Chant West are a superannuation consultancy and research firm that release a trove of data on how superannuation is rolling along in Australia. The have excelled themselves in a very timely media release. outlining that this is the 8th financial year in a row of median gains for Australian Super “Growth” funds. They define growth funds as funds that invest 60-80% of their investments in growth assets such as shares and property. Their results for the past 25 years for Australian Super Funds is presented below.

Despite the worries of the world, this last financial year, the median of Australian growth funds achieved a 10.7% return and some of the low fee funds discussed in the last post, such as HostPlus and Sunsuper achieved FY17 returns of 13.2% and 12.4% respectively in a year where the safety of cash could only yield 1.8%.

The five-year period up till now have been boom times for the share market. There will be high fives and bonuses all round for the suits that control your funds. This has been a good investing year and you should rejoice at the returns shown in your super statements when they are sent to you soon – and reflect upon the pitiful returns that you would have got if you had your super invested in a bank account.

But, it is a good reminder that not all years represent gravy for growth funds and it is the nature of these assets that their will be some yearly fluctuations. Slack Investor’s feeble memory is strong on the returns of the years 2008 and 2009 where the Global Financial Crisis caused asset prices and market returns to crash. I can remember many who lamented that this compulsory super business was a costly rort – it was tough to watch your retirement savings shrink even though money was taken out of your wages each week.

Slack Investor has a soft spot for the bard

“Ay, to the proof, as mountains are for winds, that shakes not, though they blow perpetually.” ― William Shakespeare, The Taming of the Shrew

So “shake not” dear investors … think long term and think growth … and despite the occasional disappointment … you will be rewarded! Compound interest will be doing its work on your savings in all those years that are blue in the above image – It is only fair that you have got to give compound interest the occasional year off – for recuperation!

I have updated all Index pages and charts to reflect the end of month data. .