The previous post identified residential property or shares as likely growth investments that all investors should become friendly with.

The previous post identified residential property or shares as likely growth investments that all investors should become friendly with.

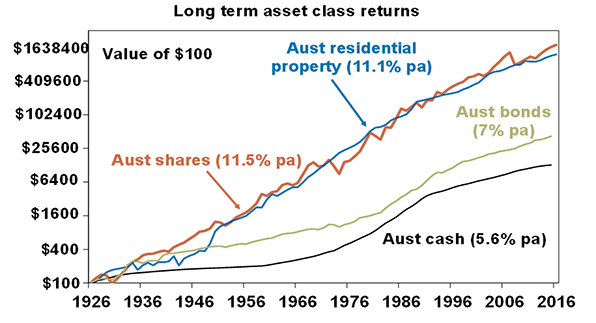

The economist Shane Oliver has collected some data on the performance of each of these investment vehicles that goes back to 1926. The graph below uses a logarithmic scale which is quite appropriate for such long term reviews where there is a big range of values. The good thing about this scale is that in percentage terms, a vertical movement of, say 10%, moves the same distance whatever the year However, the downside is that it does visually compress the dollar gains for the higher achievers shares and property – the dollar values on the left axis should be considered in detail.

Looking at the above, it is clear that Australian residential property (blue) and shares (orange) both represent good investments. These values indicate Australian averages and in some markets (Inner city Sydney and Melbourne), property has done even better!

What stands out to Slack Investor is the raw dollar values for each investment class that 90 years of investment would reap. $100 in shares or property would be worth at least a million dollars now. The raw figure returns for bonds (light green) and cash (black) of around $50000 and $20000 in 2016 are much less impressive – If you want growth … shares or property are the big games in town!

The graph above shows that over 90 years, Australian shares are a slightly better investment than Australian property – However, over different time frames, property has done better than shares. Russell Investments have put out a report analysing returns for the last 10 years to December 2015. Australian residential property gained on average 8% p.a. compared with 5.5% for Australian shares.

As well as the past returns from each asset class, there are other considerations such as tax, liquidity,, transaction costs and ability to gear – Banks have traditionally allowed higher gearing ratios for property (80-100%) compared with shares (typically 50-70%).

Despite these complexities, if you want to prepare for retirement with more than basic superannuation, you must get involved with investing in either shares or property – they are growth assets that, with careful selection, will always do well in the long term – and do especially well in times of economic growth. Investing in these assets inside or outside of superannuation will help provide for your financial independence.