Slack Investor remains IN for US, UK, and Australian index shares.

Slack Investor remains IN for US, UK, and Australian index shares.

Despite a bad month for the UK index where the previous month gains were wiped out, there are no alarm bells yet. All markets have had a reasonable financial year (to Jun 30, 2017) with 12-month returns for the US, UK and Australian Index of 15.2%, 13.0% and 9.6%, respectively. These returns, for simplicity of calculation, do not include dividends. For the Australian market, the dividends would add another 4-5%!

And now for a confession …. Slack Investor has been slack … and not moving his market index stop losses properly! I put this down to an oversight and have included an extra few columns on the Index pages to help me not do this again.

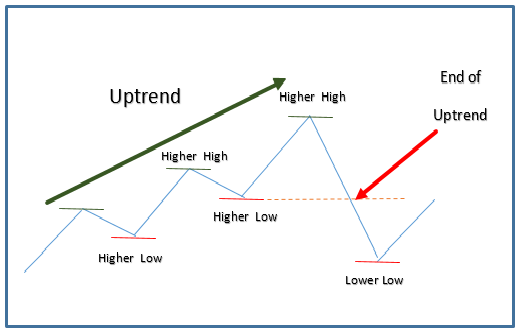

Stop Losses are very important to the Slack Investor’s method and offer a detached way in which to make decisions at the end of every month. The stop losses are set at the time of share purchase and moved upward according to a modified version of Dow theory. This trend method was discussed in an earlier post The Trend is Your Friend …

Slack Investors’s Index trading method involves moving the stop loss level upwards to a new higher low when it is established on the monthly chart. There are a couple of rules that I have to keep me in the index trade as long as possible.

Stop Loss Rule No. 1: A Higher Low can only be established below the 10-month moving average (the wavy black line on the index chart pages).

Stop Loss Rule No. 2: Stop Loss Rule No. 1. does not apply if the monthly closing price is more than 20% above the set stop loss.

For the UK Index, back at the end of February, the end of month price rose 21% above the stop loss level. I should have moved the Stop Loss level then … but I have now caught up and include the adjustment on the UK Index page. I include the technical chart information for some readers who are interested … but don’t worry, Slack Investor will tell you at the start of each month what each of his decisions are in the monthly updates for the US, UK and Australian Index.

Warren Buffet has some much more famous investment rules …

Rule No. 1: Never Lose Money.

Rule No. 2: Never Forget Rule No. 1.

Mr Buffet is being a little flippant here, and even the great investment master has lost money at times on individual investments. However, overall he has not lost money … and this is the same approach that Slack Investor is trying to emulate. It is impossible to completely avoid losses, it is just part of investing, and there is no use beating yourself up about a loss when it happens … However, you can limit losses by using stop loss levels … and, with Slack Investor Stop Loss rules … they should be limited to around 20% (there may be some slippage!.

I have updated all Index pages and the Portfolio page.