My nephew is a carpenter and he would often gleefully say “Cash is King” when offered a cash job – no paperwork and no tax. This was fine for him as he was on a travel holiday and didn’t want the hassle of being on the books and claiming his tax back at the end of his holiday.

But, to the investor, Cash is not King.

If you hold too much of your wealth in cash, you won’t be able to keep pace with inflation, meaning your purchasing power will go down and it will be more difficult for you to achieve your goals.

Black Swan Capital

Slack Investor cannot argue that money in the bank is not safe, The government guarantees balances up to $250,000.

Cash is important for day to day expenses and your emergency cash buffer, “the cushion” to keep you going for about 2-3 months in an emergency. However, to get on the path to financial independence you must invest in appreciating assets.

Term Deposits, Bonds and Fixed Interest

For a relative, Slack Investor was trying to find a place where cash would earn a decent rate – without too much risk. There is not much around. Most transaction accounts pay no interest or 0.1% interest per year. If you are prepared to lock your money away for a year in a term deposit in a major bank, you might get 0.85%. One of the newer banks, Judo Bank, is offering 1.01%.

There are a few offerings in the bonds and fixed interest area. I ended up in the Vanguard Australian Fixed Interest Index Fund with a management fee of 0.24% and 1 and 3 year returns of 3.2% and 4.7%, respectively. The fund lends money to mostly government authorities – but, unlike term deposits, the returns are not guaranteed. A similar product is offered as an Exchange Traded Fund Vanguard Australian Fixed Interest Index ETF (VAF).

Growth Assets – Shares and Property

Higher up the risk curve are funds based upon share (equity) investments. In these funds or ETF’s the rewards can be higher – but the risks are also much greater. Only invest in shares or share funds with money that you can lock away for 3 to 5 years.

To grow wealth we must have exposure to growth assets such as shares and property.

Shane Oliver, AMP

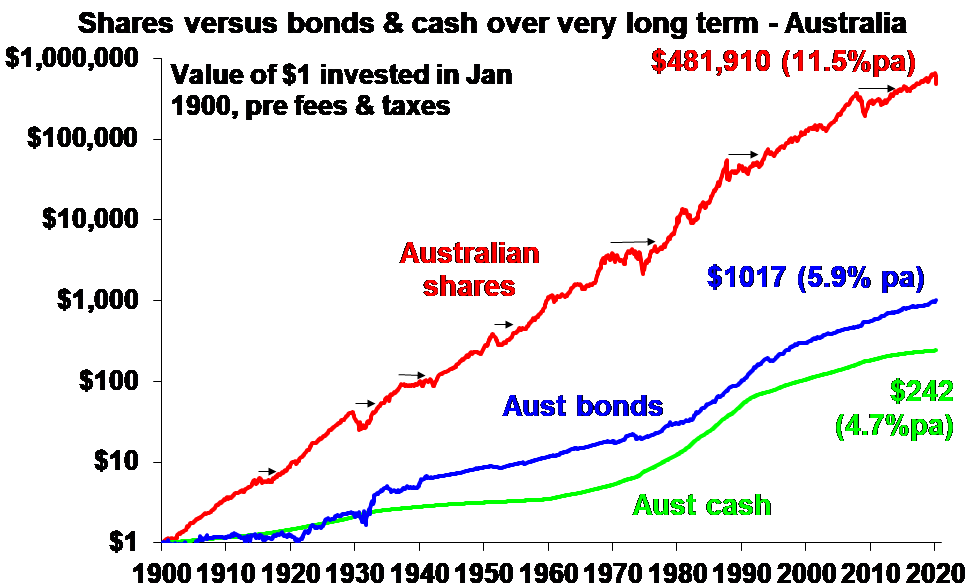

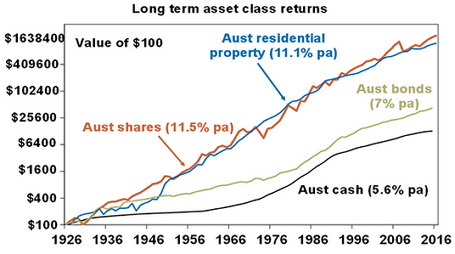

Australian shares have returned on average 11.5% per year from 1900 to 2020. The incredible value of sustained compounding over long periods is shown by the dollar amounts achieved over 120 years – A $ 1 investment yielded $481, 910 for Australian Shares, $1017 for Bonds and a paltry $242 for cash. But these high returns on investment in Australian shares did not come without risk. Since 1900, Australian shares have had negative returns for two years out of ten.

A similar chart with data to 2016 shows that Australian residential property has a similar trajectory to Australian Shares (11.1% p.a.). There are many hidden costs to owning property – but that is another story. Lower on the risk curve, are Bonds and Cash.

Slack Investor acknowledges that people have different appetites to risk, but if you are in the fortunate position to be sitting on some cash in excess of your emergency fund … the current rates for term deposits encourage a first journey up the risk curve and consider fixed interest funds or ETF’s. For money that you wont need for the next 3-5 years, then shares have the best long term returns. If your time frame is longer, then a well positioned property has been a good investment.

“Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do. So throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover.”

H. Jackson Brown Jr. from Goodreads