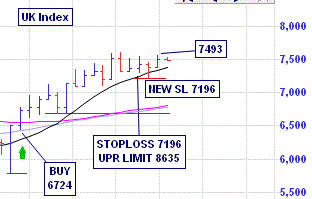

Slack Investor remains IN for US, UK, and Australian index shares.

Slack Investor remains IN for US, UK, and Australian index shares.

… and further gains for the Australian Index (+1.6%) and the US index (up 1.0%) on the month. The UK Index is in record high territory, up 4.9% in December.

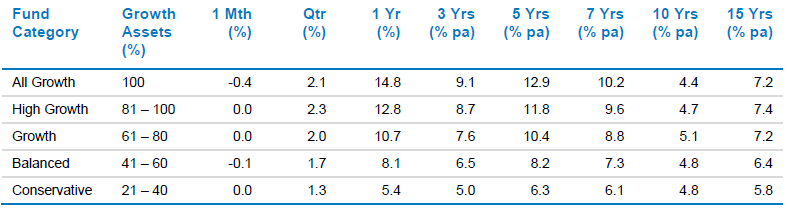

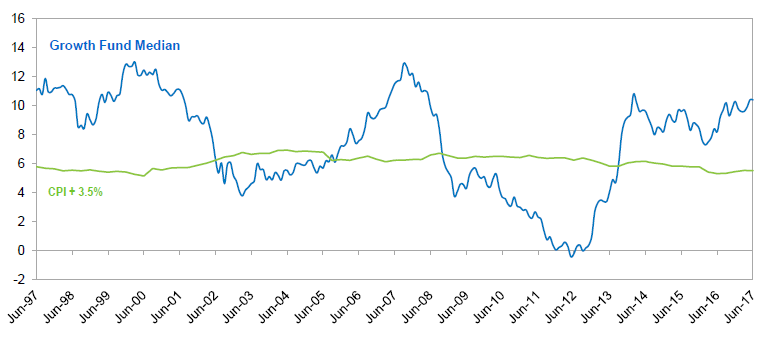

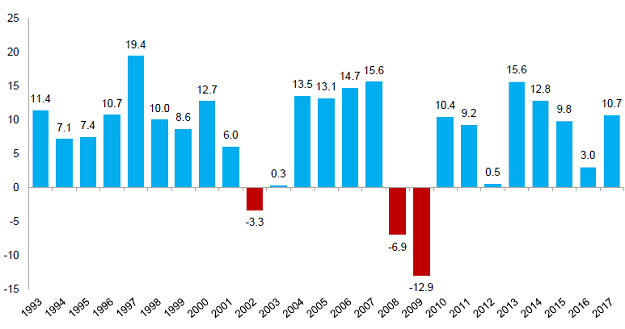

Slack Investor is on the couch again and congratulates himself for being involved with the world stock markets in an environment where a no risk cash 12-mth term deposit will reward him with a paltry 2-4% p.a.

In order to reach financial independence it is necessary to embrace some risk – but as discussed below, Bitcoin may be a “Bridge too Far”.

Bitcoin Revisited

Bitcoin is a regular feature in the papers and even around the Christmas Table. Since my last note on Bitcoin, the price has been on a bit of a wild ride.

Going deeper than Slack Investor really wants to go is a whole world of Bitcoin – and its own language – such as “forking”. This is “sort of” explained by Business Insider. Oh yes … there are “Hard forks” and “Hybrid forks” and “Coin Splits”, and “Bitcoin Cash” and “Bitcoin Gold” and … and … see Wikipedia. The complexity is amazing and “makes my head hurt”

Yet, despite this wild chart, in only a six weeks, Bitcoin has almost doubled in value.

Slack Investor has thought of another way of doubling your money that is much simpler … and faster! Go down to your nearest Casino, stroll to the Roulette table and put your investment money on “red” … No No No … Black! (This is not Investment Advice! – Slack Investor is just experimenting with a Dream Sequence). If you are lucky, you can double your stake in minutes, and walk out with a smile – or, if not, you can walk out feeling like an idiot.

The reason that Slack Investor doesn’t go to the Casino – OR invest in Bitcoin – with his hard-earned investment money is RISK. The bitcoin price might get to $100000 USD, or it might crash to nothing. The trip to the Casino and investing in Bitcoin represents too much risk to my capital.

40% of all bitcoin value is held by 1000 people. There is an obvious price risk if one of the bitcoin “whales” decides to suddenly sell. There also could be a difficulty in getting your bitcoin money out if there is a sudden crash.

What does the great investor and Slack Investor hero Warren Buffet think …

“It doesn’t make sense. This thing is not regulated. It’s not under control. It’s not under the supervision [of] any…United States Federal Reserve or any other central bank. I don’t believe in this whole thing at all. I think it’s going to implode.” – from Forbes

My case rests your honour.

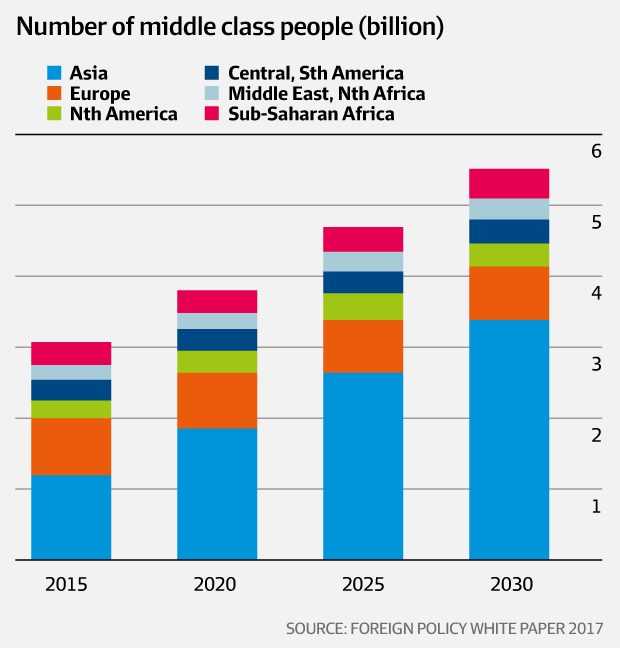

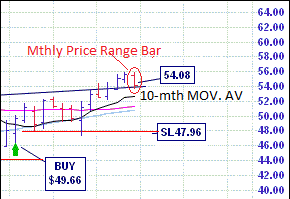

All Index pages and charts have been updated to reflect the monthly changes – (ASX, UK, US). I have also done the quarterly update on the portfolio page. A newcomer to the portfolio is the Vanguard FTSE Asia ex Japan Shares Index ETF – (VAE.AX) on Yahoo. This should give me some exposure to a wide range of companies in the growth region of Asia with not too much expense (MER 0.4%). Bought October 9, $62.34; Monthly Stop Loss $58.79)