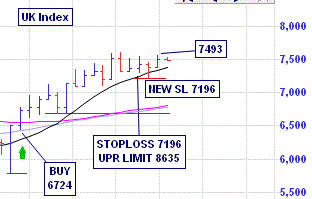

Slack Investor remains IN for US, UK, and Australian index shares.

Slack Investor remains IN for US, UK, and Australian index shares.

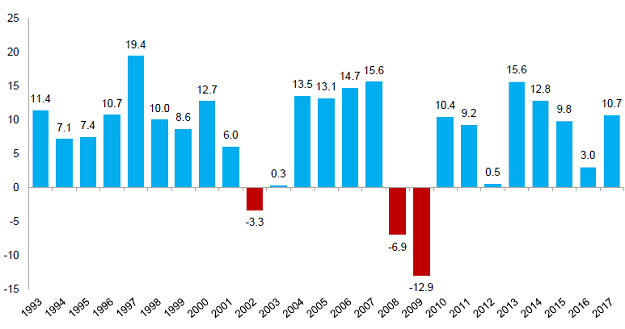

… and further gains for the Australian Index (+1.0%) and the US index (up 2.8%). The UK Index dropped 2.2% in November due to what the Financial Times attributes as the “Firmer Pound contribution”.

Slack Investor is on the couch again and

marvels at the sage judgement of the Financial Times – and most other financial publications that always assign a reason for the random walk of market fluctuations after the fact.

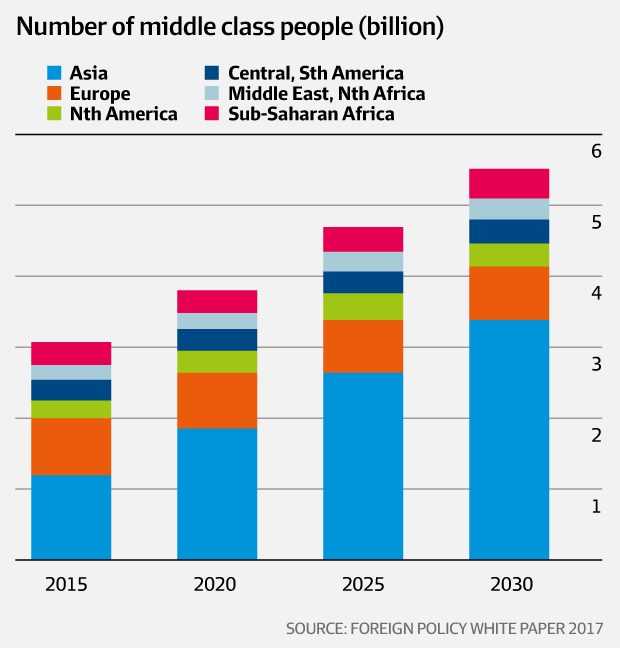

Asian middle class on the rise

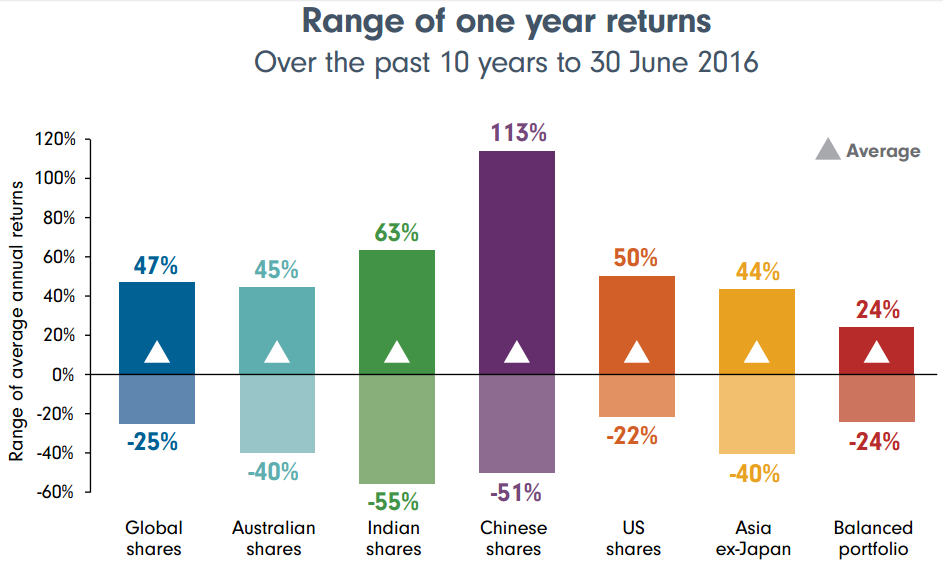

While on the couch, Slack investor has an ear out for world affairs and came across an article from the accomplished fund manager (and Asia Buff) Kerr Neilson – The Rise of Asia – worth a full read if you have the time. The article points to the need to consider Asia, and its effect on the world economy, over the next 10-20 years. It is a powerful collection of facts e.g,

- China and India have grown their economies consistently at 6-7% for the past 20 years – they are now 4 times bigger than they were in 1998.

- When measuring purchasing power, their combined GDP of US $33 trillion is 50% larger than either the US or the EU!

- China and India originate nearly 120 million high-spending overseas travellers each year.

The last point is backed up by CNN Money who report that the number of Chinese tourists travelling internationally has more than doubled to 120 million people over the last five years – 1 in every 10 international travellers now comes from China.

Chinese people tend to begin traveling abroad once their household earns about $35,000 – from CNN Money

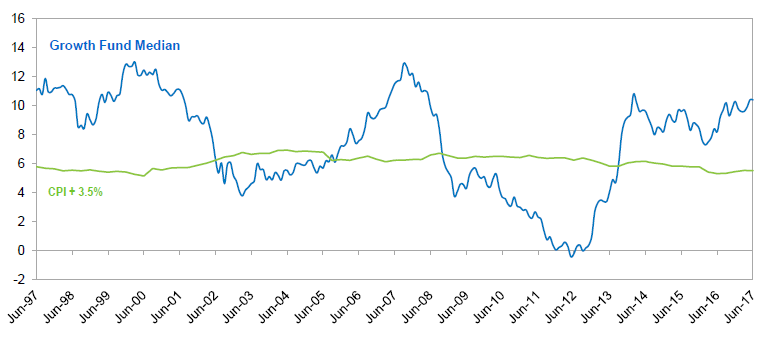

The rapidly rising middle class of these countries is behind this increased tourism and the graph below indicates the influence of these two economies will be on the rise.

Sourced from Australian Financial Review

Mental Note Slack Investor – Look for Asian themes in your investments.

All Index pages and charts have been updated to reflect the monthly changes – (ASX, UK, US).

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.