“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.“

George Soros

Now George knows how to make a dollar and, to his great credit, is a generous philanthropist. I am sure, like any successful investor, that George looks back at times on his investment decisions. Slack Investor looks forward to this time of year when I can reflectively analyse my greatest investing failures. Fortunately, my stinker to nugget ratio was good this year.

The percentage yearly returns quoted in this post include costs (brokerage) but, the returns are before tax. This raw figure can then be compared with other investment returns. I use Market Screener to analyse the financial data from each company and extract the predicted 2023 Return on Equity and 2023 Price/Earnings Ratio on the companies below. This excellent site allows free access (up to a daily limit) to their analysts data once you register with an email address.

Slack Investor Stinkers – FY 2021

Growth stocks (High Return on Equity >15% and increasing sales) are fantastic companies to associate with as they are growing and hopefully, their earnings per share, are growing also. The downside to this is that these companies are usually sought after in the stock market and command high prices in relation to their current earnings because the “future earnings” of the company are priced into the current price. This gives them a high PE Ratio. Whenever there is a future earnings revision, or a stutter in growth, there is usually a dramatic drop in price.

Slack Investor has a look at his stocks every weekend on a free chart program (Thanks Incredible Charts!). I actually pay a small amount to get the chart data early in the morning. Both of my “stinkers” this year were actually “nuggets” from last year. For FY 2020, Appen +58% and A2M +26%. Such is the cyclic nature of some growth stocks.

Appen (APX) -24%

APX (2023 ROE 14%, 2023 PE 19) remains a company that puzzles me “the development of human-annotated datasets for machine learning and artificial intelligence”. The company has had a few problems due to COVID-19 and a hit to its underlying profit and increased competition. Slack Investor got out late last year at $25.87 as the weekly chart moved below the stop loss at $28.11. However, this represented a loss of 24% for the financial year.

The downward trend marked by the thick blue line is setting up niciely for one of Slack Investors favourite chart trading patterns – “The Wedgie”. When the share price punches through a downward trend line of at least 6 months … and the fundamentals are right, Slack Investor is interested. Given the forward PE for 2023 is a relatively low 19 – I might have another crack at this once the price has poked above the blue wedge line.

A2 Milk (A2M) -21%

A2M (2023 ROE 17%, 2023 PE 23) sells A2 protein milk products to the world. The actual benefits of the A2 only protein seem to be limited to easier digestion. Long term independent studies with large data sets are still in the works … but the marketing skill of this company is undisputed. COVID-19 brought big changes to sales with the collapse of the “daigou” market and worries about China trade sanctions. Slack Investor sold about half way through the downtrend – but not before taking a hit for the team.

Slack Investor Nuggets – FY 2021

A great benefit of investing in companies that have a high Return on Equity, and with a track record of increasing earnings, is that they sometimes behave as “golden nuggets”.

Codan (CDA) +161%

What a company! Codan is a technology company that specializes in communications and metal detecting. It has made a major US acquisition this year and paid with cash. Sales are up and predicted to keep increasing. The high 2023 ROE 32%, and relatively low 2023 PE 24 (for a growth company) makes me think there will be more price growth over the next few years – I will try and top up my position this year on any price weakness.

Alphabet (GOOGL) +61%

(GOOGL – 2023 ROE 23%, 2023 PE 23) The Alphabet list of products continues to grow. I use a ton of Alphabet products every day and the company is growing fast into the cloud with cloud computing revenue jumping 46% in the March quarter. There are a few regulatory problems coming up with the US Justice department claiming that Google’s actions harmed consumers and competition. There is also the ongoing work of G7 nations trying to make international tech companies pay their rightful share of tax on revenues in each country.

Despite this, if there is one company that Slack Investor could invest in and then pay no attention to for 10 years, and still sleep well, … it would be Alphabet.

REA Group (REA) +59%

The owners of RealEstate.com.au. which is the go to portal for house selling and buying (REA – 2023 ROE 38%, 2023 PE 44). The group has just completed an acquisition of Mortgage Choice and picked up a big chunk of a Mortgage software company. This expanding of the business must be good. 65% of Australia’s adult population are checking the site every month looking at property listings and home prices. However, the 2023 projected PE is very high (44). Using the Slack Investor bench marks, suggests the stock is expensive at the moment.

Integral Diagnostics (IDX) +37%

This medical image company (2023 ROE 16%, 2023 PE 24) provides diagnostic image services to GP’s and specialists. IDX seems to be getting a few tail winds with an ageing population and more demand for their MRI, CT and PET scans.

Macquarie Group (MQG) +36%

Macquarie is a complex business(2023 ROE 14%, 2023 PE 17) with a range of banking and financial services, and plays in global markets and asset management. The latter division looks for undervalued companies. Despite COVID-19, profits are increasing. The management seem to know what they are doing – Slack Investor remains a fan.

Betashares Global Robotics And Artificial Intelligence ETF (RBTZ) +36%

This ETF tracks the megatrend of robotics and artificial intelligence. Although the PE ratio is a bit high (2021 PE Ratio 37), this is a disruptive sector that should make gains against existing industries with the advantage of technology against rising labour costs.

Most honourable mentions to those other companies that returned over 20% for the tax year. Cochlear (COH) +34%, BetaShares Nasdaq ETF (NDQ) +33%, VanEyk MOAT ETF (MOAT) +32%, Vanguard International ETF (VGE) +29%, BetaShares HACK ETF (HACK) +31%, Vanguard Asia ETF (VAE) +28%, BetaShares QLTY ETF (QLTY) +25%. To these companies, I am grateful for your service.

Slack Investor Total SMSF performance – FY 2021 and July 2021 end of Month Update

A great year for shares, Chant West reports Super funds have delivered their strongest financial year result in 24 years, with the median growth fund (61 to 80% in growth assets) returning 18% for FY21. The FY 2021 Slack Investor preliminary total SMSF performance looks like coming in at around 22%. The 5-yr performance is a more useful benchmark to me – as it takes out the bouncing around of yearly returns. At the end of FY 2021, the Slack Portfolio has a compounding annual 5-yr return of over 21%.

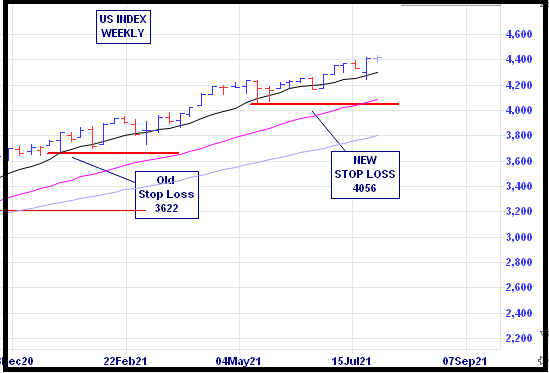

Slack Investor remains IN for Australian index shares The FTSE 100 had a flat month (-0.1%) but rises in the US Index S&P 500 (+2.3%) and the ASX 200 (+1.1%).

The party with the US S&P 500 just keeps on going. As the S&P 500 has moved more than 20% higher than its stop loss on the monthly chart, I have adjusted the stop loss upward to 4056 from 3622. It is difficult to decide where to put the stop loss on the monthly US Index chart. In these cases, I go to the weekly chart and look for a “sensible place” to put the stop loss coinciding with a minimum value (dip) on the chart. The current stop loss is 8% below the end of month price.

The US economy entered a recession in February 2020 and has now entered a phase of expansion (since June 2020). Slack Investor is nervous though and has his stop losses live for all Index funds. I will be checking these charts on a weekly basis for breaches of the stop loss.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index).