“Rembrandt … says things for which there are no words in any language.”

Vincent Van Gogh

Slack Investor doesn’t put himself in the class of Rembrandt but he admires the honesty of this self portrait at age 53. It is time well spent to look a little further into his amazing catalogue.

Rembrandt, despite incredible talent and artistic output, was known to have lived beyond his means and, he sadly died in 1669 at age 63 as a poor man. He was known to have done over 40 self portraits in his life. Perhaps after 5 years of Slack Investor, it is also a time for self reflection.

Slack Investor doesn’t possess any great financial skills. My financial talents pale in significance with the great investors. I didn’t go to a private school but my government school was one of the better ones and I scraped into a science degree at university. My Physics and Maths marks didn’t put me on the honour board – but I passed. One thing I am grateful for is that my parents instilled a desire to make the most of any opportunities that life presents. Skills that I do have are a willingness to learn and the “stubborness” to complete a task.

Although Slack Investor has been very fortunate in his life with opportunities to travel and work in many interesting countries in his twenties. My own financial story is not really one to emulate. I had a delayed journey to financial independence by returning to Australia at 29 broke, no superannuation, and owing money. My limited skill set was lucky to include the ability to learn from others and to be single minded in pursuit of a goal – that was, to be financially secure.

My journey was greatly helped by going to an investing class by Robbie Fuller, He had selflessly contributed his investing knowledge to a U3A class in Townsville for over 20 years and also ran an evening class for investors. I learned a lot from Robbie. He showed me how to look at a companies sales, debt levels, future earnings and potential growth and to try and assess its real value (fundamental investing). He also opened up the world of charting to me. Looking at a price chart of a company – trends, breakouts and stop losses (technical investing) – and I am grateful. A basic knowledge of the fundamental and technical aspects of investing is so important – and not many people have this knowledge.

However, not everyone can have a convenient investment class in their town. I originally started this blog as a means to show those interested in investing that, by gaining a few skills, you can become a better investor and manage your own financial affairs at a minimum cost – knowledge is power.

Never depend on a single income. Make Investments to create a second source.

Warren Buffet

Slack Investor hopes to keep going. I am sure that Rembrandt had a good life -an enormous creative talent, a love for his wife Saskia, other relationships after his wife’s sad death, a son and a daughter. However, Rembrandt earned much, and he lost much. He was forced to sell his house and most of his art collection for a pittance to avoid bankruptcy in the late 1650’s. A bit of financial self reflection is often required if you want to achieve financial independence – Take control.

Slack Investor’s Favourite Charts

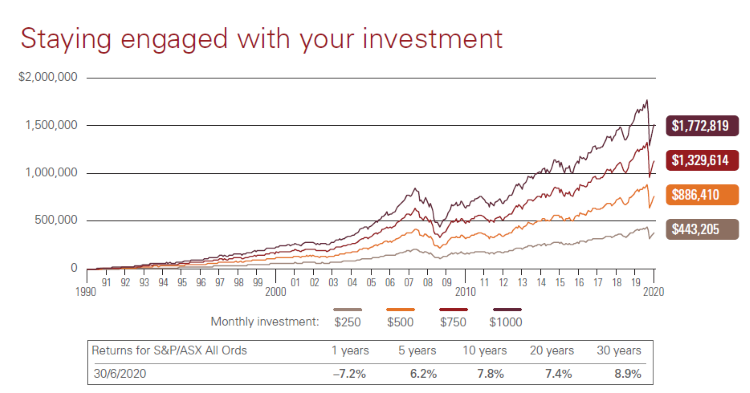

There are lots of great charts on the web. I look forward the release of the Vanguard Index chart every year – and this will be the subject of another post when they release the 2021 chart. However, the chart below drives home the benefits of consistent investing over time – and I like that.

This chart shows the beautiful connection of constant investing and time. Over 30 years since 1990, the chart shows the 2008 GFC crash and last year’s Covid-19 crash. Despite these major downturns. given time, their is always a recovery. An investor who starts with nothing but invests in a US index fund by contributing $250 per month would have compounded $443 205 by the end of 2020. If the investor had increased the monthly contribution to $1000, then the rewards would be $1 772 819.

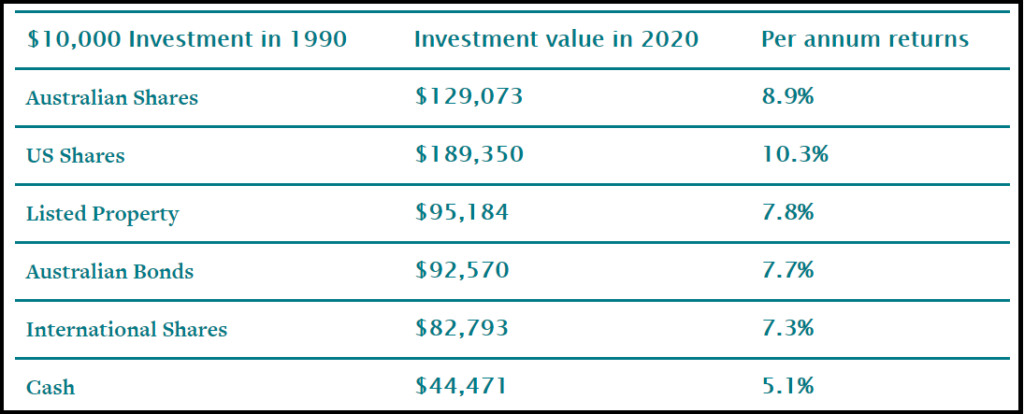

Another way of showing the benefits of time and compounding investing is to look at the average returns on a single investment of $10 000 in various asset classes over 30 years.