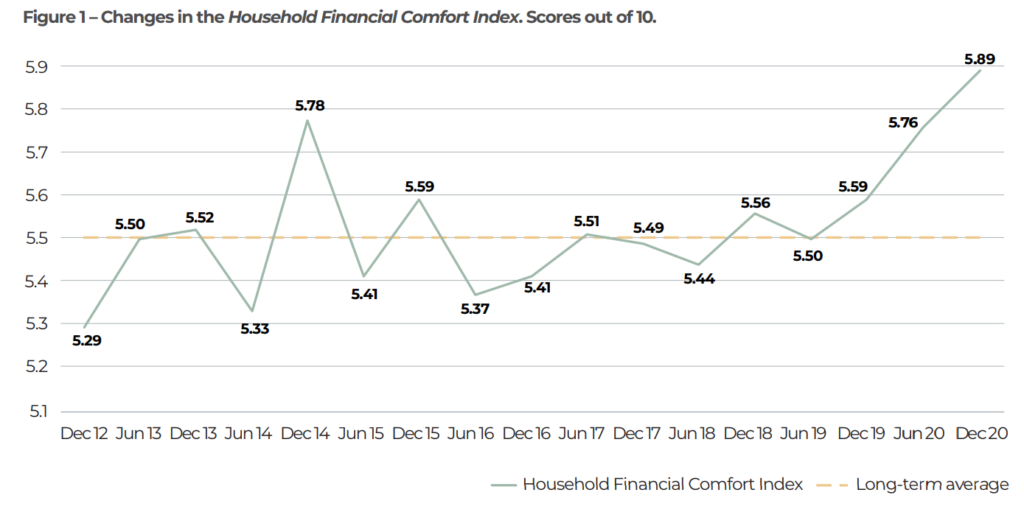

The couch seems to be looking good for some, but not for others. ME Bank have updated the annual Household Financial Comfort Index that surveys 1,500 Australians every year to get an idea of how Australia is travelling in a money sense. Slack Investor was surprised at the research results which revealed that over the past six months, to December 2020, the “financial comfort” of Australian households has reached a record high of 5.89 out of 10. This index is 5% higher than before COVID-19! However, it is full-time workers that report the highest financial comfort across the workforce.

The high financial comfort can probably be linked with some households going into “savings mode” as the uncertainty caused by COVID-19 on the economy, and the very high levels of government support.

Although, not everyone feels the same after a year of COVID-19. About 30% of households said that their financial situation has worsened. Clubs, pubs, gyms, air transport, restaurants, education, and the creative arts were hit particularly hard – with the cohorts of casual workers and adults under 24 shouldering the burden of Coronavirus disproportionally.

Household Response to the Pandemic

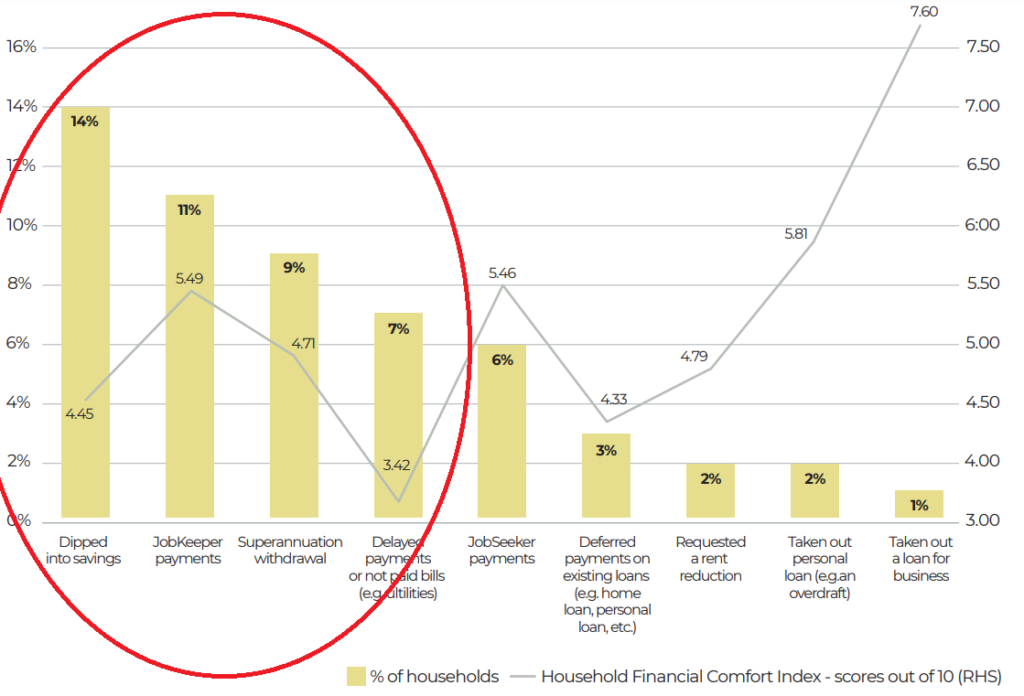

The main ways that households chose to ease the effects of the pandemic were 1. Dipping into savings (14%); 2. JobKeeper payments (Govt. wage subsidy) (11%); 3. Superannuation withdrawal (9%); 4. Delaying bills (7%). With JobKeeper payments having now ended, the raid on super halted, and the other main methods likely exhausted, it looks like a tipping point is approaching.

“And, at $90 billion, (JobKeeper) it’s the single largest economic support program that any Australia government has ever undertaken.”

Australian Treasurer Josh Frydenberg – ABC News

The Australian government’s massive JobKeeper program ending is likely to cause a big rupture in the economy with many small businesses who have, till now, been just “hanging on “. Many of these businesses are likely to cease trading. For employees, Treasury estimates that up to 150,000 workers will move from JobKeeper into unemployment.

Financial Cushion

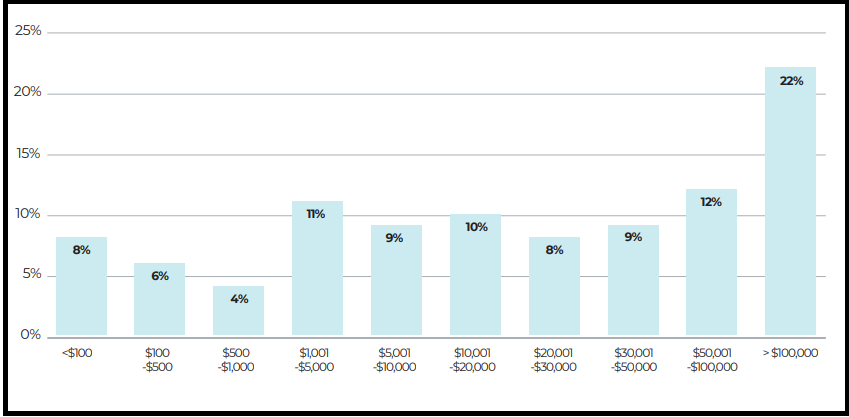

With tough times ahead, there will be many who would wish for a financial cushion. Slack Investor has often banged on about the need for an emergency fund of cash that will help when one of life’s inevitable bits of bad new turns up. In December 2020, about one in five households reported virtually no, or very low, amounts of cash savings (<$1000).

As for the pandemic effect on retirement savings, the reality of individual super balances is starting to bite with the report revealing that only around 18% of households expect to fund retirement with their own superannuation and 42% expecting to use both private savings and the government pension.

“Financial comfort levels are up for now, but many households

Household Financial Comfort Report – 2020 ME Bank survey –

are on the cliff’s edge. They’ve lost income, their jobs and entire

livelihoods, their wafer-thin savings buffer is dwindling, and government support is the main action stopping them from falling over.”

March 2021 – End of Month Update

Slack Investor remains IN for Australian index shares, the US Index S&P 500 and the FTSE 100. All Slack Investor followed markets this month had solid rises (ASX 200 +1.8%; FTSE 100 +3.5%; S&P 500 +4.2%).

In these uncertain times, especially with the high prices on the US market, I am monitoring my index funds weekly and if, at the end of the week my Index funds are below the stop loss, then I will put a post on the blog and sell at the next opportunity. All Stop Losses are Live.

All Index pages and charts have been updated to reflect the monthly changes – (ASX Index, UK Index, US Index). The quarterly updates to the Slack Portfolio have also been completed.