Slack Investor would like to develop this page further as SMSF’s are a great way for the Australian Investor to take control of their finances – and keep costs down.

I started an “individual trustee” SMSF with my spouse, Ms SI, in 2009 and it is a fantastic way for the hands on investor to look after retirement funds. There is some yearly paperwork and minute-keeping – and usually some investment decisions that must be made during the year. But this tedium is balanced by the enormous flexibility that a SMSF provides. Stock selection, cash weightings, and transferring money in and out are all a breeze for the SMSF trustee.

I use the low-cost administrator e-superfund – they have been a great administration service and continue to innovate and streamline procedures each year. I have no connection with e-superfund other than being a very satisfied client. My overall SMSF costs per year are a fraction of percent of the portfolio value (0.12% for FY 2017) – and my affairs are reasonably complicated as one of the accounts is in pension phase and needs a yearly actuarial certificate. e-superfund take care of all the back end stuff, provide educational articles on their site and submit tax returns for the funds on your behalf after you attend to a (mostly) pre-filled check list.

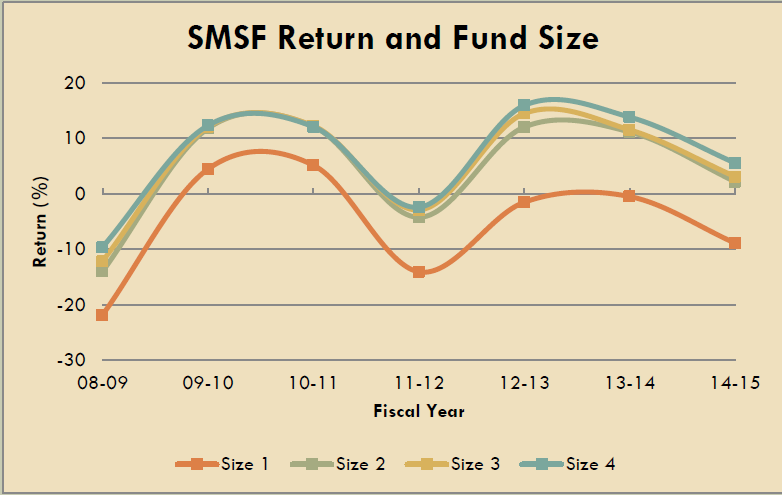

It is vital that you continually monitor the performance of your SMSF against benchmarks. If, over a 3-5 year period, you were having difficulty keeping up with the benchmarks, it might be time to “know when to fold ’em” (Thanks Kenny)! Your benchmarks should be selected to reflect what you want to achieve with your fund.

Even though SMSF’s have many advantages and my experience with them has been extremely good. I would probably only recommend the set up of an SMSF’s to the “interested” investor. Some of the Industry superannuation providers provide excellent superannuation service for a reasonable cost – and this would suit most people.

Because my wonderful and dear spouse (Ms SI) doesn’t quite share my passion for financial matters, when Slack Investor “shuffles off this mortal coil” OR, becomes mentally challenged (hopefully not for many, many years!) I will recommend to my spouse that she shuts down the SMSF. She could rollover the SMSF into an industry fund or invest directly into ETF’s and draw off the dividends for living expenses.

Things to think about

- You are the controller of the fund (There are some responsibilities and legal obligations) and as the trustee of your own fund, you have ultimate responsibility for what your SMSF invests in.

- Costs – These are important and should be below what it would cost you to be in an Industry fund. There is a great level of variation between different types of super fund, for example:

Not for profits had an aggregate fee rate of 0.85% (0.96% for Industry funds)

Retail funds had an aggregate fee of 1.48%

SMSFs had an average expense ratio of 1.12% – but costs generally go down with large fund balances. The Slack Fund has a tiny expense ratio (0.12% for FY 2017)

- Minimum Balance – This is important From a Rice Warner submission in 2013, they recommend a minimum initial balance of $200 000 for SMSF’s – Under this balance and the funds tended to underperform.

Advantages

You choose what to invest in – This includes residential or commercial property. This control may be particularly useful for small business owners who might use their SMSF to own their commercial premises. Other more “fruity” investments include unlisted businesses as a private investor, gold or other precious metals, works of art, or cryptocurrencies (Just Don’t!).

Cost

Slack Investor likes to keep costs low and take responsibility for his investments and if you want to set up an SMSF, rather than follow the crowd, choose a low cost administrator like e-superfund and educate yourself on stock selection – After all, not everybody is a skilled investor, the most commonly owned stock of all SMSF’s is Telstra (TLS) a stock with a stagnant (or possibly declining) dividend.

Tax advantages

Unlike most retail funds where accumulation accounts and retirement accounts are offered as separate products. With a SMSF, there is no need for accumulation stage assets to be sold when moving into the retirement stage. This represents a great saving in capital gains tax. Retirement accounts for those over 60 are exempt from capital gains tax.

Control over your accumulation and Pension accounts

Having mony in you pension account has great advantages. All earnings and capital gains are tax free. A proviso of these accounts is that the ATO dictates how much you must withdraw ( a percentage dependant on your age).

When markets are in a downturn, it may not be a good time to “cash out” and withdraw money. If you have a SMSF, it is relatively easy to to do a “rollback” where you transfer your super balance back from your pension account into the accumulation phase without having to sell assets. This will reduce the required pension cash out and hopefully allow your assets time to recover before accessing them.