Especially when the thing you don’t see is your money!

I know things are difficult out there … rents are high, things break, bills keep coming in, and everything seems to be going up – except for your wages. But, if you can have the discipline to save even a little bit of your money, your wealth fund will be able to establish some roots … and this start is a huge and necessary step to financial independence.

Through experience, Slack Investor knows that it is easier to save money close to the source – if you can quarantine some of your income at the time of payment, – all the better! Start up an online, no fees, bank account and tell your boss that you want a portion of your pay put into this. If your employer can’t do this, then set up a direct transfer from your wages bank, the day after payday, to your online savings account. It is done … you are on your way.

In the parable from the financial classic The Richest Man In Babylon, the rich man Algamish passes on the secret of his wealth to the financially challenged scribe Arkad –

“I found the road to wealth,” he said, “When I decided that a part of all I earned was mine to keep. And so will you.”

Algamish suggested at least 10% of your wealth was to be put aside – and Arcad, with his mentor’s help, also became a rich man in Babylon. Arcad was not lazy with his money and understood the power of money and time through compounding interest …

“Then learn to make your treasure work for you. Make it your slave. Make its children and its children’s children work for you … Invest they treasure with greatest caution that it may not be lost.”

Back in the real world, and far, far from Babylon … So many Australians have built their wealth through real estate. Increasing land values have helped this (Especially in Melbourne and Sydney) … but a big reason why home ownership is a vital stepping stone to wealth is that the banks will lend you 80% of the asset value (If you satisfy their income tests!) … and you are “forced” to quarantine your monthly loan repayments from your spending. This is “forced” saving and most homeowner’s, up until now, have found a way to make these payments each month. Business Insider quote a Standard and Poor’s report of an Australia wide loan delinquency rate of only 1.29% for January 2017. This figure will most certainly rise as we go into an interest rate increasing regime – but that’s another story!

Salary sacrifice into superannuation is another way of putting a portion of your wages aside and “paying yourself” in a tax-advantaged way. This strategy has great benefits for older folk but, … this has little appeal if you are 40 years from retirement.

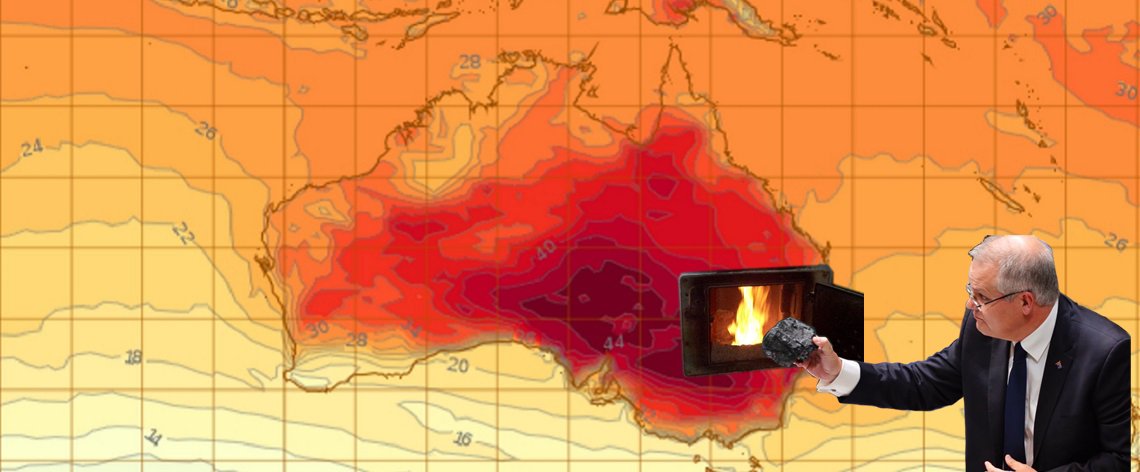

But wait … Hidden in SCOMO’s 2017 Australian budget there is a tantalizing offer to the young home saver who wants to quarantine a bit of money for their future wealth … The First Home Super Saver Scheme. The unfortunately named, deflating sounding scheme has the acronym – FHSST … and will be discussed next post.