There are many ways to measure a happy and successful life – and financial security is just a part of this. Benjamin Franklin best sums it up

There are many ways to measure a happy and successful life – and financial security is just a part of this. Benjamin Franklin best sums it up

“Content makes Poor Men Rich; Discontent makes Rich Men Poor.”

To be grateful and happy with our many blessings is a good place to start – But, to be financially secure is one of the three tenements of a happy life. My Dad did give me the great advice …

“The only time that you use borrowed money is for the purchase of appreciating assets.”

This meant I would avoid the crippling credit card interest by paying off my credit card balance every month (Admittedly, there were a few slip-ups!) and, most importantly, if I wanted a car or holiday, I would have to save up for it first – and pay cash before the glorious enjoyment of my purchase.

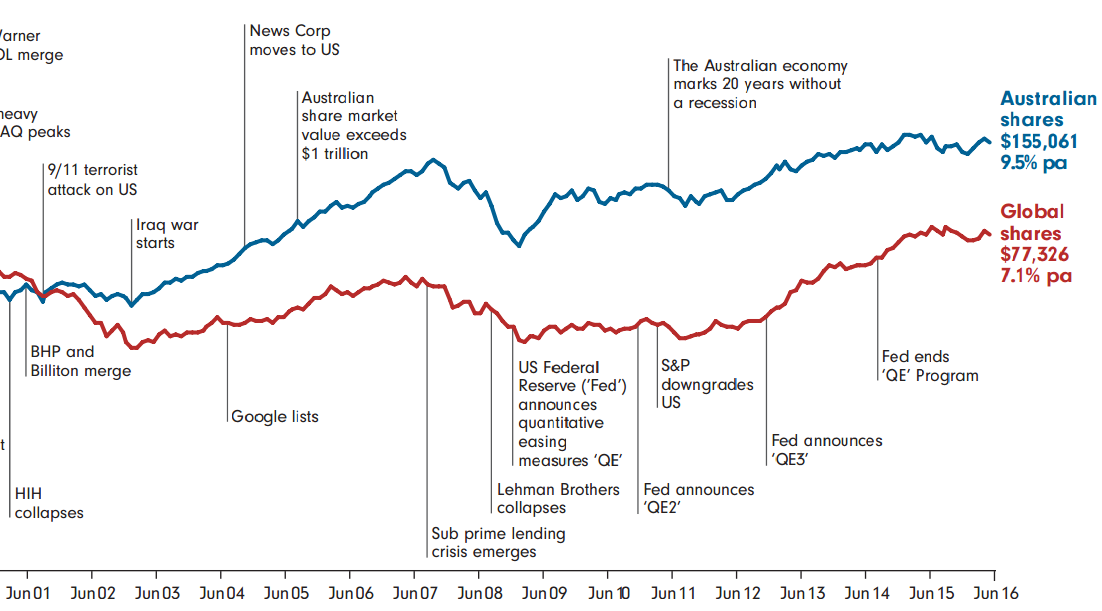

However, (hopefully) appreciating assets like property or shares were given the big tick by my Dad – and it was OK to borrow money for them. I suppose my Dad would have made an exception to the rule if you were investing in yourself. Spending borrowed money on things like education or, if you are just starting out, tools, a work ute, or office equipment – can be justified.

This makes Slack Investor a bit of an outlier in the community considering the amount that the average Australian owes on credit cards. ASIC has a Debt Clock and they point out that there is around $32 billion owing on Australian credit cards, that’s an average of around $4,300 per card holder!

There are some basic rules for getting ahead financially and Noel Whittaker points out the differences between winners and losers in the financial game.

“The winners borrow at low rates of interest, subsidised by the Tax Office, to buy growth assets such as property and shares that increase in value over time. The losers borrow at high rates of interest, non tax-deductible, for consumer items such as cars that depreciate in value.”

You can argue about the fairness of negative gearing and capital gains concessions (I think rightly!) and superannuation concessions (Which have been recently reigned in) – but these are the existing rules.

If you start at a young age with just my Dad’s advice … and only borrow to invest in, hopefully, appreciating assets – it will be a good start. My Dad was an understanding bloke and would appreciate that there were some cases where the rules need to be broken – i.e. suppose that you needed a car for your job – but he would insist that If I did borrow for a car that I would shop around an get the best loan deal … and hopefully, I would be able to pay it off early.

Slack Investor can’t guarantee financial security – but If you follow my Dad’s simple advice you will be on the right path to be a financial winner.